Future Trends: Paid-for Loyalty

05 Mar 2020

Part of the 2020 Customer Engagement campaign in collaboration with Collinson, dotdigital, Paragon Customer Communications and in partnership with Foresight Factory, here’s the third article of our Future Trends series.

After the analysis of brands’ voice strategy and personalisation through new technologies and strategies, this article will focus on loyalty programmes.

We are seeing a general transformation of the meaning of loyalty as consumer’s become more easily swayed. In other words, brands have to accept that loyal customers don’t necessarily need to be monogamous.

In this report, we will focus on paid-for loyalty offerings - when customers decide to commit to a specific brand and purchase a package of benefits which allows them to access premium services. For many, this decision isn’t only driven by convenience and there are several factors that play a key role.

What is the new currency to buy your customers’ loyalty? Customers love when brands seem to have spent time thinking about them as individuals rather than the collective. They want brands to consider their lifestyle and interests.

Read on and find out what customers’ loyalty looks like and a few tips for you to consider when thinking (or re-thinking) your loyalty strategy.

The Insights

What loyalty looks like

As we saw in our ‘How to win trust and loyalty’ report, 49% of consumers are ‘Active Loyals’

(those who tend to stick to brands they know for everyday and important decisions), a proportion that seems to have remained stable over recent years.

Only around one in five (22%) is defined as an 'Active Disloyal' (customers that are much more likely to be disloyal in their approach to brands) and also has not moved compared to previous years.

However, data also suggests that consumers’ belief in their own loyalty is shifting, as a significant group declared they feel more disloyal than a year ago. In particular, nearly two-fifths of consumers agreed they were feeling less loyal to brands and companies than in the past, while just 18% disagree.

Considering the constantly expanding range of offers and an overpopulated market, consumers are increasingly focused on ensuring that the engagement with brands is worth it.

In other words, for customers to stay, brands are challenged to rethink their reward strategies as consumers expect their loyalty to be recognised across more metrics than spend alone.

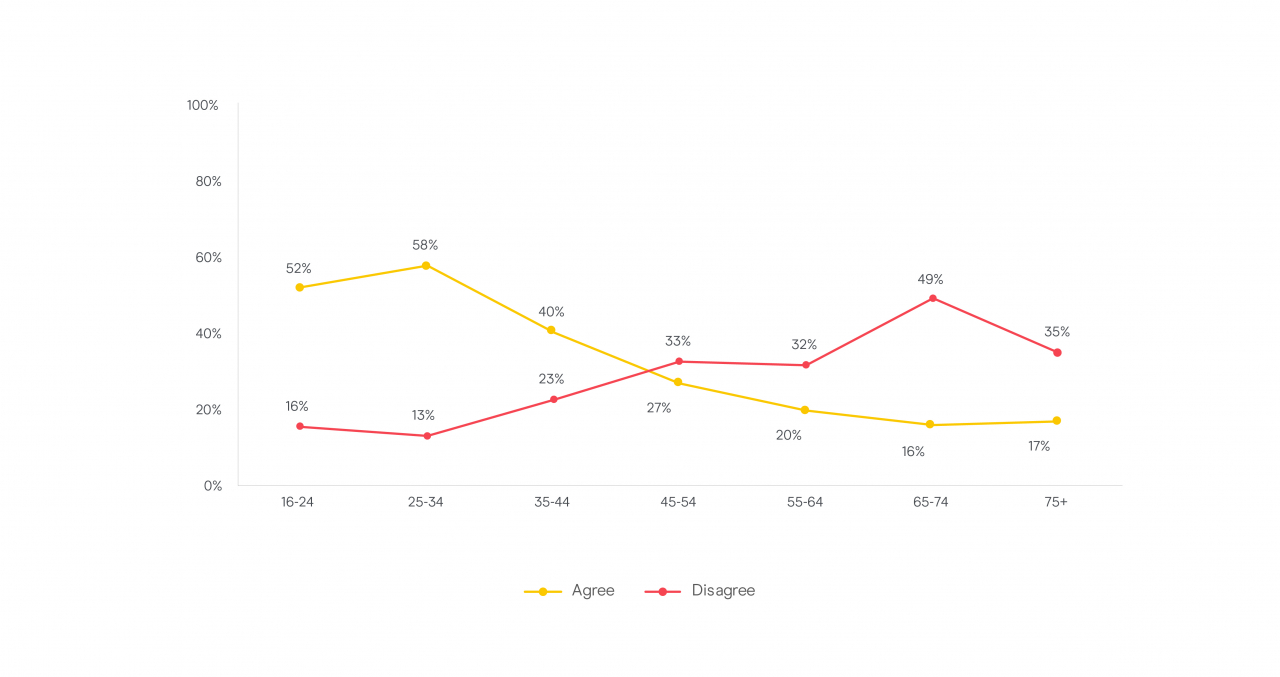

The appetite for loyalty and reward points is somewhat saturated as people are demanding benefits fulfil their needs. This is clearly visible when we look at how both women’s (62%) and men’s (45%) realisation of value from loyalty cards has declined steadily over the last decade (below).

I really value the benefits I get from loyalty cards

.jpg)

Thanks to their increased knowledge and expertise in managing the relationship with brands, consumers have come to expect more convenience and efficiency along the whole customer journey.

With a third of customers (34%) demanding more tailored and alternative benefits (below), the strongest appeal comes from Millennials (born between 1981 and 1999) and Centennials (those born after 1999).

I would like to receive more gifts/treats from brands in return for my loyalty instead of points

In the future, along with rewarding more consumer behaviours, brands will need to include more creative perks – like niche fan groups, as well as early or exclusive access to content, products and experiences.

Furthermore, rewards will underline brand values by, for example, donating to social and environmental causes while deals targeted at the masses will decline.

The Opportunities

Paid loyalty

Benefits come with a price and in the last few years, we’ve seen several brands drawing the line between free benefits and paid benefits. In the first case, we are looking at earned loyalty, which comes as a reward for customers being in a long relationship with their brands. These rewards as a ‘thank you’ from brand to customer.

In the second case, we are talking about paid-for loyalty: consumers decide to purchase a benefits package, bringing their ‘commitment’ to the brand to the next level.

This extra access has a perceived value beyond its price tag. Indeed, for many customers, it can be driven by factors such as the brand’s allure, a high level of trust, the self-recognition of the customer with the brand.

A win-win for brands

How can companies benefit from paid loyalty programmes? The equation seems pretty simple.

Applying Pareto’s 80/20 rules, a brand’s top 20% of customers typically account for 80% of the company’s sales. Consequently, paid loyalty programmes help the company highlight those top customers and meet (or even exceed) their expectations.

In return, companies receive increased average order value, order frequency, and elevated customer engagement.

Amazon Prime is probably the best known long-term example of paid-for loyalty and it's been hugely successful.

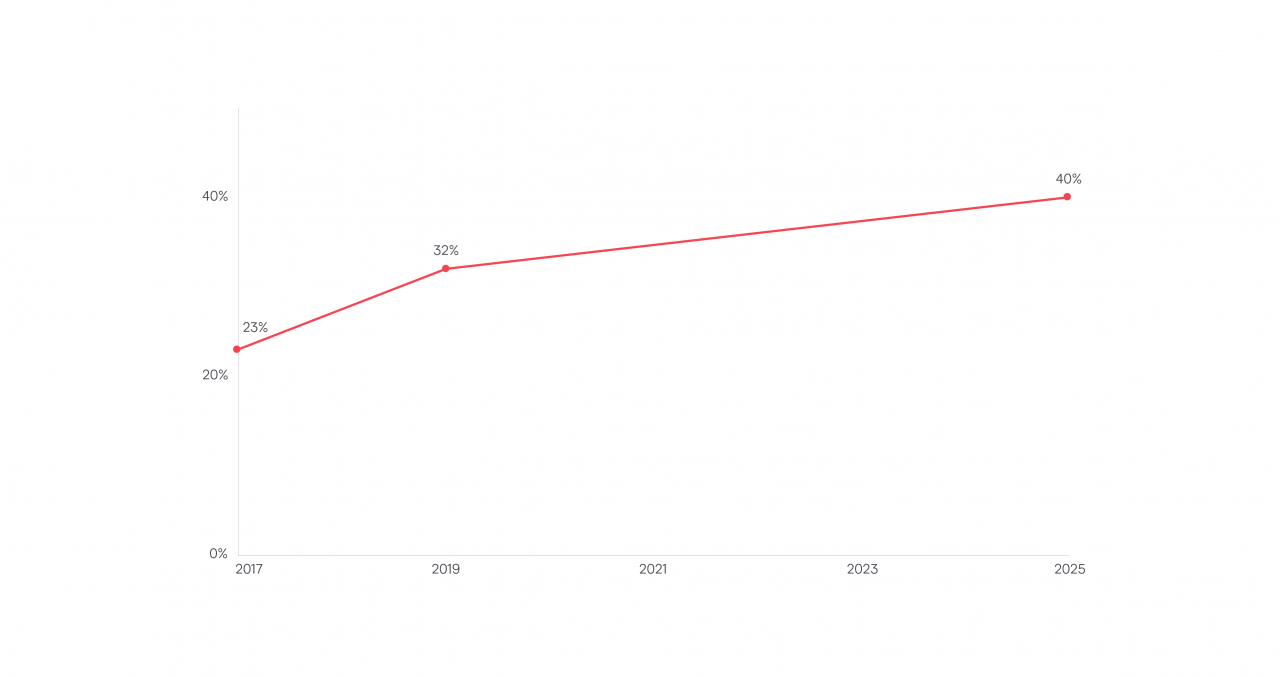

The proportion of UK consumers who subscribe to, or have access to, unlimited next-day delivery (not just via Amazon) has increased from 23% in 2017 to 32% in 2019. Most recently we’ve seen a rapid increase in adoption among those aged over 75.

Foresight Factory forecast this to increase to 40% by 2025, with a further 18% interested in subscribing meaning this could continue to grow.

Access to a paid unlimited next-day delivery service

Harnessing consumer data to make programmes more engaging, personalised, and effective is the key to success. People are willing to pay a premium for things that make their shopping, and more in general their life, easier. For example, thanks to the incredible amount of data that passengers produce during their customer journey, airline brands can tailor loyalty programmes and assist their customers from the booking to the return moment.

Furthermore, brands can also focus on more emotional benefits, by offering loyalty programmes that provide value in the form of a community rather than discounts or gifting.

What is essential, is a real passion and enthusiasm for the brand or product as the starting point.

It will then follow a natural community that thrives on the exchange of reviews, opinions, tips and ideas. Great examples can be found both in the footwear and beauty sector.

Paid-for loyalty programmes are gaining considerable traction among consumers and is an area where we will see more innovation and growth.

Purposeful rewarding

There is also another way, which rewards customers by looking after causes they care about. The DMA found that nearly 60% of consumers who categorise their loyalty to their favourite brand as genuine, named brand social responsibility as a reason for their loyalty.

Consequently, brands could offer the opportunity to turn loyalty points into eco-friendly or ethical rewards, allowing members to choose rewards that support selected social causes or environmental programmes (e.g. carbon offsetting, tree-planting, ocean clean-ups).

Ultimately, having this ‘shared battle’ could appeal to those who wouldn’t normally think to donate to such activities and will strengthen the emotional connection between the consumer and the brand.

Questions

- How would you consider your customers? Loyal or disloyal?

- What is the new currency to earn your customers’ loyalty?

- What are the barriers-to-purchase that might hinder customers in engaging with your brand or create hesitation along their purchase journey?

- What common ground do earned and paid-for loyalty programmes share?

- What do your loyalty programmes of the future look like?

Takeaways

So how do you make your loyalty programmes, whether earned or paid, part of a winning strategy?

Fight choice overload

In our previous article, we explored the exciting possibilities that new technologies and strategies offer brands to engage with their customers. Data allows brands the ability to guide users through the different offers saving them from that sense of choice overload.

Thanks to increasingly powerful tools able to collect and analyse customers’ data, marketers can gauge and anticipate the needs and desires of their audience. At the same time, consumers have increasingly sophisticated tools to ensure they are extracting maximum value from the loyalty programmes they participate in.

For instance, in Autumn 2019, Facebook acquired New York-based start-up, CTRL Labs, which is building an armband that is said to translate the wearer’s movements and neural impulses into digital signals. Intrusive or a perfect fit solution to really get under the customer’s skin?

As long as brands make clear their intentions to their customers, using their knowledge ethically and purposefully, new technologies (as mentioned above) are the perfect ally to improving what they can offer.

Flexibility and immediacy

Earlier we mentioned the interest in next-day delivery services increasing and consumers in urban areas could earn access to same-day or two-hour delivery services.

Time is a currency, consumers are looking to maximise it and this is why these services will become more and more compelling among customers. Consumers ‘live in the moment’ and they want their brands to do so too – actually, 30% of consumers describe themselves as impatient – in particular, Millennials seem to be at the edge of their seats constantly.

Consequently, this aversion to waiting fuels the creation of on-demand goods and services and the correlated death of logging-in, form-filling, and waiting for approval.

Serendipity and surprises

Within an environment of predictability and control, good surprises are always welcome. In 2018, 32% of UK adults expressed a desire to be more open to change – a great opportunity for brands to embrace ‘the unexpected’ within their offering.

This percentage will also rise to 51% by 2025 according to Foresight Factory’s predictions.

In conclusion, offering new easy routes to discovery and breaking people’s routine with something unexpected are two strategies that brands should consider while building their own loyalty programmes.

Case Studies

Here are a few examples of how paid-for loyalty programmes can bring the relationship with customers to the next level.

Rapha cycling Club: Get more from your riding

CVS Carepass: The membership for your non-stop life

Sephora: A Concierge to Spoil Gold Members

Thought for its top-tier loyalty programme members (those who spend more than S$1500 annually), beauty retailer Sephora launched a Gold Member Concierge service in July 2019.

Laka: Community bike insurance

Methodology

‘Future Trends: Paid for Loyalty’ is an initiative undertaken by the DMA in collaboration with Collinson, dotdigital, Paragon Customer Communications and partnership with Foresight Factory.

The report partially reviews data from the ‘Customer Engagement: How to Win Trust and Loyalty’.

Moreover, the DMA Insight department conducted desk research on industry trends using the Foresight Factory’s FFonline platform: most of the reported data has been collected through surveys conducted between 2016 and 2019.

The report was written and designed by the DMA Insight department and in-house design team.

If you have any questions about the methodology used in the report, you can contact the DMA’s Insight team via email: research@dma.org.uk.

The Rapha Cycling Club (RCC) is a global community of passionate and active cyclists with exclusive access to products, experiences and offers for cycling lovers.

The Rapha Cycling Club (RCC) is a global community of passionate and active cyclists with exclusive access to products, experiences and offers for cycling lovers.