DMA Insight: Consumers' Favourite Brands in 2020

06 Jan 2021

In our latest Customer and Engagement research ‘How to win Trust and Loyalty’ sponsored by dotdigital and Collinson, we asked consumers a simple question: “Thinking about all the brands and companies you use, which would you say is your favourite or you’re most loyal to?”

Read on to discover who are consumers’ favourite brands and why some struggled to select their top picks.

Amazon still leads, but has yet to become a titan

Amazon turned out to be the most mentioned brand, with 15% of consumers naming it, followed by John Lewis (4%), Sainsbury’s (4%), and Tesco (3%).

When we asked the same question back in 2018, the top choices looked very similar. Indeed, consumers mentioned Amazon (14%) followed by equal percentages selecting Marks & Spencer (4%), John Lewis (4%) and Sainsbury's (4%).

Somewhat surprisingly, despite Amazon’s near-ubiquity across so many areas of consumption, the brand hasn’t gained any further traction with customers over the last 2 years.

Hypothetically, a reason behind such consistency can be explained by consumers’ view of Amazon more as a service provider rather than a brand to engage with. Data also reveals consumers’ loyalty to Amazon as being driven by convenience (54%) rather than a genuine connection (46%).

Consumer loyalty is sparing

When we asked consumers to tell us their favourite brands, a quarter (25%) mentioned other brands outside the top ten, highlighting the variety of businesses that have managed to conquer consumers’ loyalty and that big brands are not as dominant as we might expect.

Data also revealed that about a third of consumers (35%) report not feeling loyal enough to any brand to name it as their favourite. This group’s voice is a clear testimony of the daily challenge brands must deal with: connecting with customers, gaining their trust, and being thought of when it’s time to purchase.

Future brand loyalty is within your control

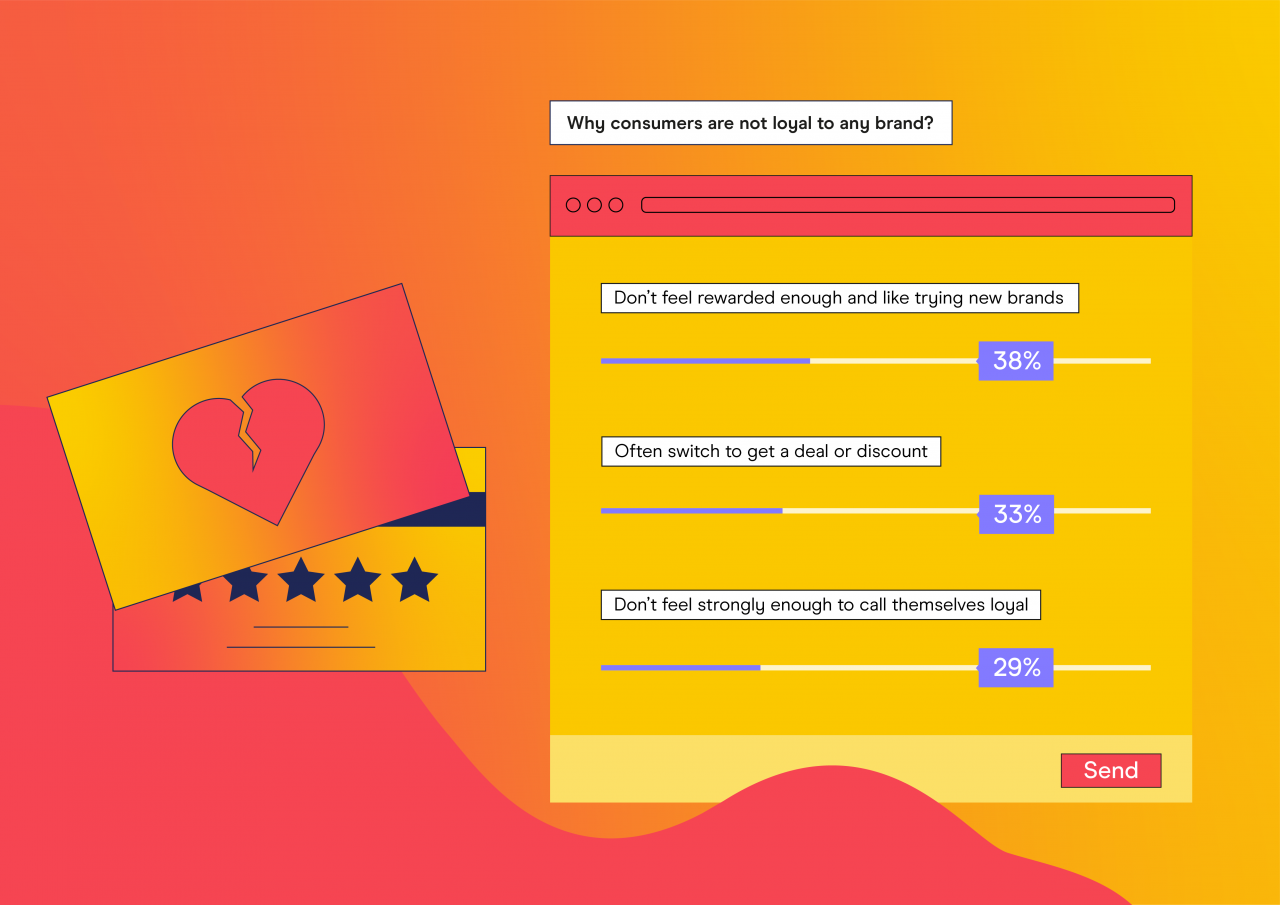

We also dug further into why these consumers do not feel a sense of loyalty towards any brand.

Consumers offered a range of reasons, from simply not feeling strongly about brands to wanting to try new ones, we’ve highlighted the most selected combinations.

The good news is that two out of the three reasons given are barriers that brands should be able to overcome themselves, with the right strategies.

Indeed, reward mechanisms for continued loyalty, such as wider benefits and offers, can be revisited to give consumers relevant value. Furthermore, innovation and communication about improvements can be used to attract those who seek change and novelty.

Yes, there may be a group (29%) who is not keen on engaging with brands, apart from transactionally. But otherwise, there is a potential opportunity for brands to re-engage those customers whose loyalty hasn’t been assigned yet. It might be a difficult task, but persistence is the winning card in the loyalty’s game.

Discover more details on these and other insights in our full report and its dedicated webinar.

Please login to comment.

Comments