30th Mar 2022

Future Trends: The Evolution of Direct-to-Consumer

Welcome to the third article of the DMA's Customer Engagement: Future Trends 2022 series, sponsored by dotdigital, Merkle and Salesforce.

Within the first trend article we analysed the changes in consumers' actions and mindset, in a more digital and social media-managed world to shed light on what influence winning strategies will look like tomorrow.

In the second, we investigated the opportunities that people’s stronger interest in sustainability is offering brands to both gain and retain customers. Indeed, amid the pandemic consumers' concerns about environmental and social sustainability have only intensified, making it an increasingly important differentiator for brands.

This third trend will focus on the relationship between brands and consumers, specifically on the brand-to-consumer (DTC) formula. The number of companies selling direct-to-consumer, bypassing traditional retailers or other intermediaries, has grown significantly amid the pandemic. Often this has been through dedicated standalone platforms and offerings that brands create, with success bringing closer and more engaged customer relationships than ever before.

Furthermore, brands have started to look into the next opportunity that the DTC trend might offer, by forming new partnerships with other like-minded businesses. These brand integrations are a new chance to engage new audiences, offer more personalised customer experiences and real value to both brands and consumers.

Keep reading to learn how DTC businesses are evolving - the strategies and tactics they are implementing to take the relationship with their customers to the next level.

The Trend

One of the most significant accelerations in consumer behaviour brought about by the pandemic was the shift to online retail. This shift was felt by a third (33%) of UK adults who reported expecting to shop online even more in the next year, compared to pre-pandemic - while half (56%) expect to keep the frequency of their digital shopping similar to previously.

This is where the direct-to-consumer (DTC) model has benefitted from the increase in e-commerce activity. Lower overhead costs and potentially closer relationships with customers also make DTC a winning strategy beyond the pandemic period too.

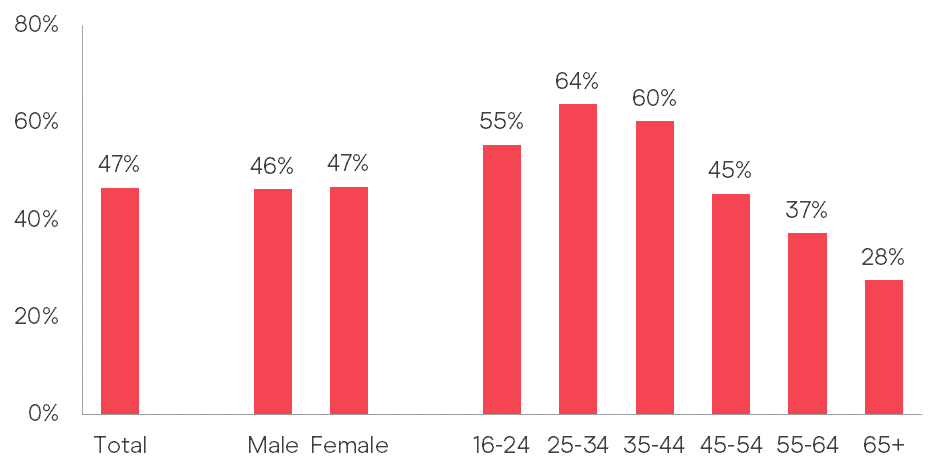

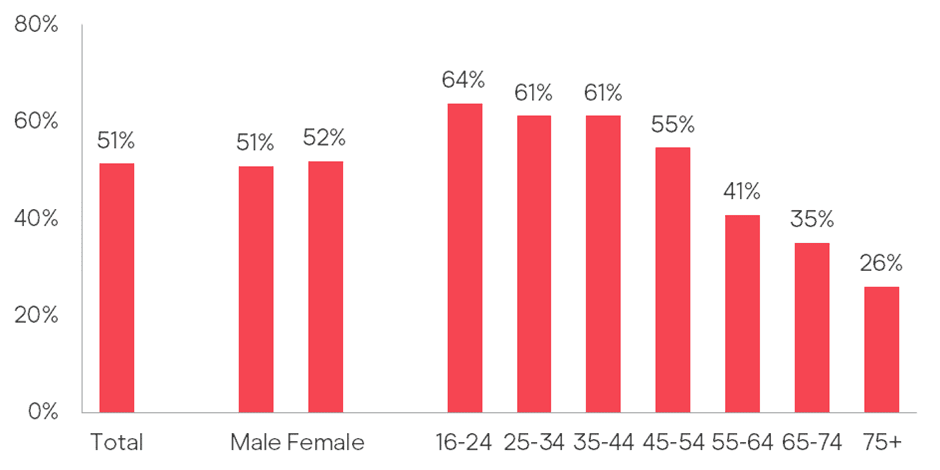

Indeed, nearly half of consumers (47%) say they wish they could shop directly from their favourite brands online more often. This has some significant shifts according to age, but it’s notable that consumers up to the age of 55 appear to feel this way. For people aged between 25 to 45 years old, this figure rises to over 60%.

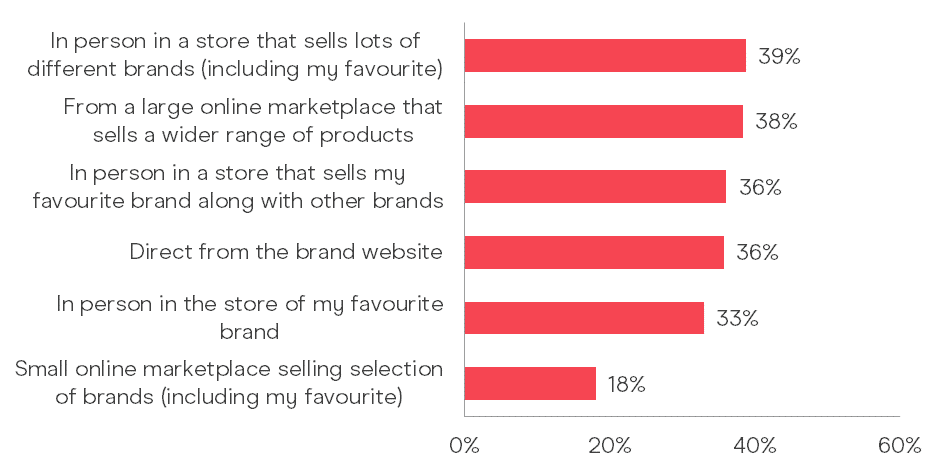

However, this push toward direct relationships is also slightly countered by the want for more choice. Alongside direct brand relationships, whether digital or in-person, over a third of customers also continue to find large online marketplaces and multi-brand stores appealing too.

Giving rise to the opportunity almost one in five consumers are already interested in. That of small online marketplaces offering select brands (18%), sitting somewhere between the direct retail experience and a mass marketplace like Amazon.

While DTC is often considered a strategy of the start-up disruptors, the events of the last two years have changed that. Today, several established brands have switched, added or are building DTC activity into their customer engagement programmes. Some incumbent retailers are also partnering with traditionally DTC brands to give both the chance to engage and acquire new customers – whether online or off.

It's this evolution of DTC as a partnership between brands that we want to understand as part of this article.

The Insights

Opportunity Amid Times of Change

The pandemic not only changed consumer behaviour but also significantly altered business behaviour – disrupting the supply and pricing of products. In these times of change, it is the agile brand that gains more traction. Brands and platforms that can offer consumers a new or alternative offering to match their changing needs – and offer the decision-making support to give them confidence in unsure times too.

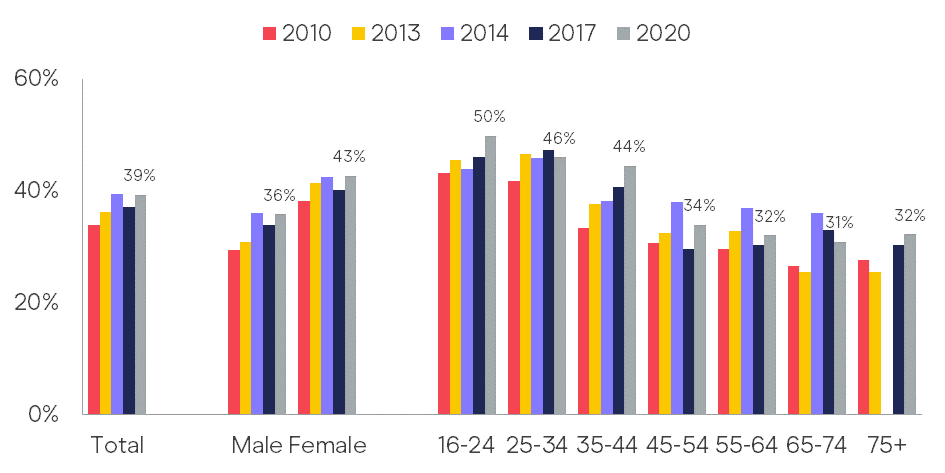

Almost one in four consumers (39%) agree that when they’re making an important purchase decision there is actually too much information for them to go through. This rises to half for younger customers and is also slightly more likely to be felt by women.

Facing this wealth of choice, information and the decision-making challenges they create, consumers search for sources of assistance. These feelings of pressure can contribute to the need to find ‘Choice Partners’ to make decision-making a more efficient process.

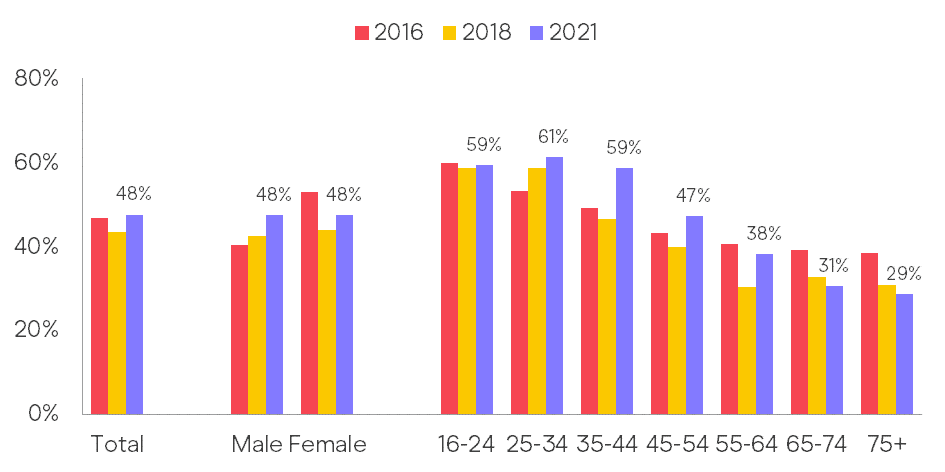

Half of consumers (48%) agree that they would like it if the recommendations they received were better tailored to their likes and interests. Meaning there is an opportunity for brands that can build on time-honoured traditions of personalisation and knowing their customers.

However, better recommendations may just be the start, as interest in automating parts of the purchase journey and the role of influence continue to evolve. Indeed, half of consumers (52%) say they would be interested in a service that automatically switched their household utility supplier so that they always got the cheapest tariffs – interest is relatively unchanged since 2017.

As discussed in our previous Influence in the Age of Social Media trend, the role of influencers and peers via social channels is a growing source of purchase guidance too. Although what this looks like in the coming years is still something for debate.

Passive Consumption is Over

Many DTC brands emphasise their connection with the customer as a key asset and part of the engagement programmes. For instance, often hosting customer events (virtual or in-person), sharing blogs/social content, community engagement activities and also promoting user-generated content. As such, the consumer can feel more like a stakeholder in the brand too, rather than just another customer.

Many customers are already open to a more active role in new product and service development with their favourite brands, with half in support (51%) and less than 15% disagreeing with this sentiment. While this stakeholder mindset is more prevalent in younger audiences, it remains over half for those consumers up to 55 years old – even beyond that, there’s a healthy interest from anywhere from a quarter to a third of consumers.

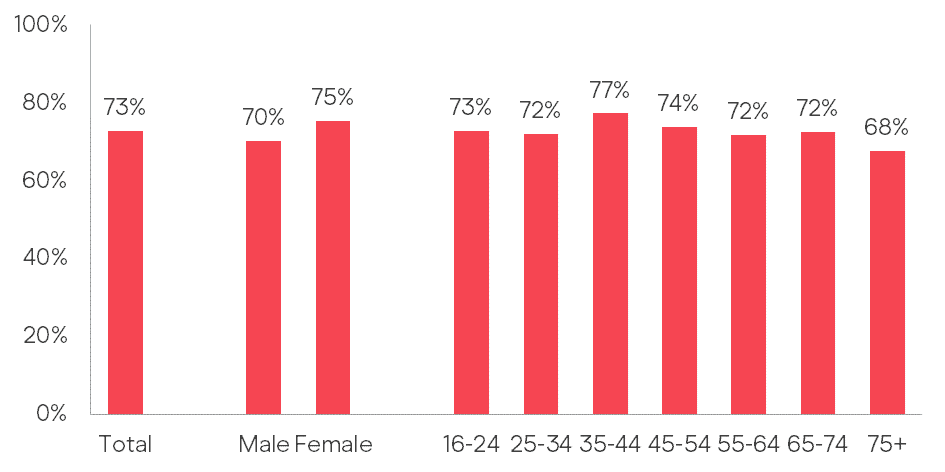

The majority of consumers (73%) already expect companies to use their feedback to improve product or service offerings. Something felt near universally across genders and age groups too. Highlighting the ubiquity of expectation that brands act on the feedback they receive from customers.

Some customers are already interested in going further than just feeling like a stakeholder too, wishing to contribute money as well as their ideas. By 2020, almost one in five (18%) UK consumers reported contributing to a crowdfunding website, with a further quarter (25%) interested in doing so in the future.

Takeaways

Balancing Choice - A Lesson from Behavioural Economics

The paradox of choice is an age-old retail debate that pits two opposing ideas diametrically against one another. First is choice, the offering of a wide range of products enabling customers to find something to meet their needs perfectly. Second is its paradox, where too much choice leads to clutter, confusion, complexity and ultimately a painful shopping experience.

This paradox created the potential for a vicious cycle where the more options, the more the customer’s brain is overloaded with information, more stress is created, the more customers will look to take shortcuts and end up making a sub-optimal decision.

Psychologists Sheena Iyengar and Mark Lepper discovered this in a famous study they published in 2000. In it, they found customers offered 24 different types of jam were less likely to make a purchase than those offered only 6 types. Highlighting a potential ‘decision paralysis’ created by having too much choice and no purchase becoming the safest option.

This is where the evolving models and platforms of DTC brands could learn a great deal. Offering the opportunity to find new brands through those they trust already, whether through affiliate programmes or collaborating to build joint platforms to sell to customers.

Reciprocity is everything

Even if your brand is not DTC, get used to acting like one. Consumers are becoming accustomed to interacting with brands intimately and in real-time: they want their questions answered quickly and their opinions (and criticisms) taken on board. Ensure you have the infrastructure in place to follow suit, and reward customers for their input, good or bad.

Selling direct also gives you control over every aspect of the customer journey, arming you with data and insights to constantly make the experience better. Use this power wisely: harness this information to personalise customer experiences for every individual, adapting messaging and channels of communication to suit their preferences.

Empowered consumers expect a more reciprocal relationship with companies and content creators in the categories that most matter to them. Many are open to being consulted as stakeholders, with the power to consult, co-create and ultimately determine commercial offerings for themselves. We are entering a new era where customers are treated like peers and collaborators – rather than anonymous economic units whose sole purpose is to consume, without input or question, the latest marketing message or offer.

Stakeholder expectations

Consumers and fans are increasingly willing and able to directly finance their favourite campaigns, projects and products into being, via crowdfunding platforms and follower-funded content models.

This is an approach that demands businesses be run for the benefit of multiple stakeholders, including customers, employees, communities and the natural environment – and not just shareholders. As new movements and commitments in this space grow, companies are likely to come under pressure to outline how they are run for the benefit of people, not just profit.

Questions

Are your customers ready to strike up a direct relationship with your brand?

Do they have the headspace or the inclination to go direct?

What would be your DTC USP?

How can your brand incorporate user-generated content in its campaigns?

Have you considered tapping into existing social media communities to broaden your brand's reach?

Can your brand offer consumers a more personalised experience?

Can your brand shake up an existing category to offer a simpler way for customers to get the results they want?

Case Studies

Lick Promises Convenient and Sustainable Home Decor

Launched in 2020, direct-to-consumer paint company Lick aims to transform home decorating with its curated approach to paint and wallpapers.The company offers next-day delivery on all its products, including its samples, which are peel-and-stick paper rather than traditional, sometimes messy, mini paint pots. Lick also offers virtual consultations with experts (on up to three rooms for £45) to give customers colour and style advice, and its newsletter and blog share tips and tricks. Its products and services are specifically designed for DIY projects, with wallpaper that is easy to hang and clean, and "easy-on" paint that promises an even finish. Its website features a carefully chosen range of 49 paint colours and 25 wallpapers to make selecting paint or wallpaper more manageable.A key part of the company's ethos is a commitment to creating more sustainable, safer products. The company raised £3 million in summer 2020. It reports that as of 1 February 2021, it has planted over 2,000 trees and removed almost 7000kg of plastic from the ocean thanks to customers' purchases.

Geenie: Beautiful Inside and Out

Geenie is an e-commerce platform that matches shoppers to indie beauty brands based on their values. All the brands featured on the website are BIPOC-owned and some promote sustainable and ethical production. The platform, launched in 2020, is defined by its founder, Chana Ewing, as being “rooted in intersectionality”. Using Instagram’s power of reach and the interactivity of other social media platforms, Geenie is building its own community of beauty lovers. The aim is to provide resources to educate and support consumers on issues connected to ethical shopping and anti-racism.

Erbology Offers Personalised, Nutritious Snacks Via Subscription

In 2020, healthy food brand Erbology launched a tailored snacking concept dubbed Erbology Personalised.Customers take a two-minute quiz on the brand's website relating to their food preferences and sensitivities or intolerances, and the system recommends between one and three options of flavoured crackers to try. They then have the option to make a one-off purchase of six boxes of their selected flavour or sign up for a subscription delivered every two weeks or once a month. The crackers are made from organic ingredients and contain activated seeds, which means they are soaked for a period of time and reportedly made better for the digestive system.The company reports doubling its revenue since the pandemic hit. It initially reached out to customers to test its personalisation concept and reports that over 70% of those invited expressed interest in being involved in testing.

Methodology

'Future Trends:The Value of Sustainability’ is an initiative undertaken by the DMA in collaboration with dotdigital, Merkle and Salesforce and in partnership with Foresight Factory.The report partially reviews data from the ‘Customer Engagement: Acquisition and the Customer Mindset 2021’. In addition, the DMA Insight department conducted desk research on industry trends, including the use of Foresight Factory’s FFonline platform.If you have any questions about the insights or methodology used, you can contact the DMA’s Insight team via email: research@dma.org.uk.

In partnership with ...

Related events and webinars

Related courses & qualifications

NOT A MEMBER YET?

Join today

700+ organisations. 27,000 marketers. One mission.

We’re uniting the marketing world with our innovative and inspiring customer-first approach. We provide resources, training, and support to empower marketers to ensure responsible data use, meaningful connections and sustainable success.