Future Trends: Power of Brand Coalitions

11 Feb 2021

Part of the Customer Engagement content and insight, in collaboration with dotdigital and in partnership with Foresight Factory, this is the second article of our Future Trends 2021 series.

Following the revisited analysis of subscriptions, after 12 months of significant change, and ahead of the final trend looking at engagement opportunities around gaming, this theme will focus on loyalty. Specifically, the power that brand coalitions could have on what both customer acquisition and loyalty programmes look like in the future.

Generally, customers still value loyalty programmes, but they want them to be more personalised both in the experience and offers they include. How can any single brand offer this? That’s where brand coalitions come in: a group of like-minded organisations that team up to offer customers a more holistic loyalty experience. This allows customers to earn and spend across a range of brands they already know or love, as well as encouraging them to engage with brands they may not have tried before too.

A cornerstone for businesses that want to group with other brands is the creation of a strong, mutually beneficial partnership where all the parties involved are able to benefit from increased engagement and spend.

There are three ways that this idea of a brand coalition could manifest:

1. True Coalitions: A group of like-minded brands, all committed to a joint programme that will benefit all customers, allowing them to earn and spend across the coalition

2. Partnership Coalitions: A single brand leading the programme, using partnerships with other brands to offer its customers additional benefits

3. Intra- Coalitions: Brands that are already part of a collective (a holding company or corporate structure) offering customers the ability to move within the group

True Coalitions may be challenging to achieve, but the forerunners of Partnership and Intra- Coalitions leading us to this ideal scenario are already growing in popularity. So, what is the appetite among consumers for these coalitions? What new opportunities do they offer to brands?

Read on and find out more about what customers want in return for their loyalty and how you could actually earn it by encouraging them to engage with another brand.

The Insights

Do people engage with loyalty schemes?

As we saw within our latest ‘How To Win Trust and Loyalty’ report, the majority of consumers are loyal to brands in some way – whether that is felt actively (51%), habitually (17%), or situationally (11%). Meaning just one in five (21%) are actively disloyal in their approach to brands, a figure that has remained unchanged in recent years.

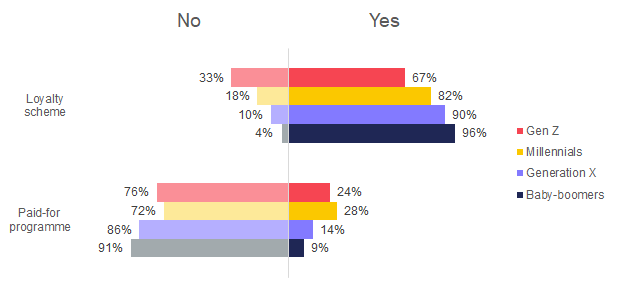

Despite this consistency, engagement with loyalty schemes has some significant generational differences. Older generations are significantly more likely to be members of existing loyalty programmes with supermarkets (72%) and retail (41%) – the most popular overall. On the other hand, a third (33%) of Gen Z consumers say they are not members of any of the loyalty programmes we asked about.

This generational difference flips when looking at paid-for loyalty programmes, where customers have to pay a regular fee (monthly/annual) to receive various benefits (discounts, free delivery, or priority access). Here, a quarter (24%) of Gen Z consumers have already signed up for such a scheme and an equal group (24%) would be interested in doing so in the future. A similar story is true for Millennial consumers, where 28% currently are and 23% would like to enlist a paid-for loyalty programme.

Are you a member of a loyalty scheme/paid-for loyalty programme?

The reason behind the interest in such schemes seems to be strictly connected to the relevance of the features offered. Indeed, data reveals the customers that do use loyalty schemes value the rewards and benefits they receive, although this has slipped slightly from 78% in 2018 to 66% in 2020. So, what benefits and rewards would help driving this figure back up in the coming years?

What do customers want?

Our previous customer engagement research highlights the most unmet benefits of loyalty programmes often relate to a lack of personalisation. Meanwhile, the least appealing, relate to more traditional elements one might expect to find, such as points, reinforced by a decline in the desire to buy from the same retailers to build up as many loyalty points – from 66% in 2018 to 60% in 2020.

This emphasises the need for brands to move towards more meaningful personalisation and tangible benefits to engage consumers more strongly with their schemes. Therefore, brand coalitions could offer a unique opportunity to give customers more personalised rewards experiences and flexibility that they are clamouring for.

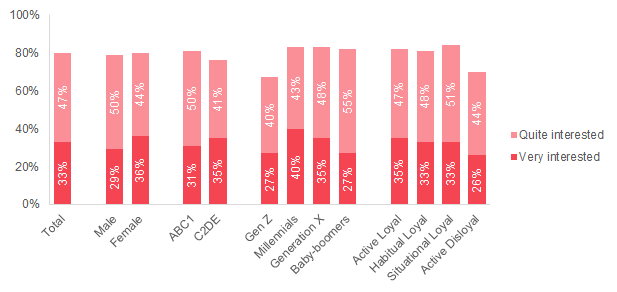

The majority of consumers (80%) show a clear interest in joining a loyalty scheme that would allow them to collect and redeem rewards from a group of brands. While the level of enthusiasm shows some shifts, the general interest in accessing these types of loyalty programmes appears high across gender, generation, socio-economic grade, and our loyalty segmentation – the latter meaning it even seems to have some appeal to those that are actively disloyal to brands.

Interest in Brand Coalitions

The Opportunities

Despite the high level of interest registered, building these types of loyalty schemes between, within or in partnership with other brands is not without challenges.

Relevancy

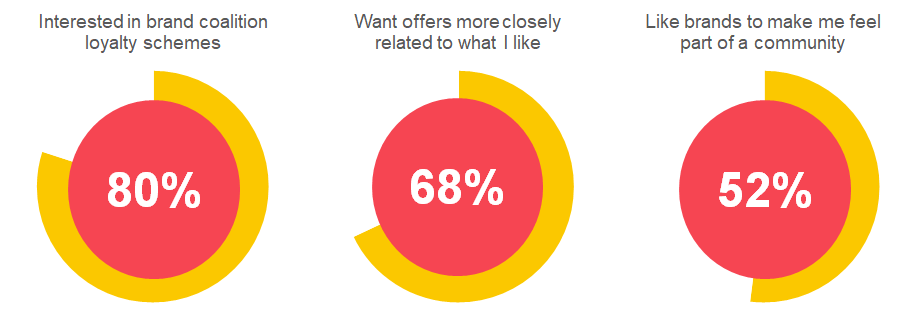

As we’ve already seen, a rewards system built around brand coalitions – whether these are ‘True’, ‘Partnership’ or ‘Intra’ – is something customers are interested in (80% saying so). This collective rewards system overcomes a range of barriers to engaging with loyalty programmes too.

They allow brands to satisfy consumers’ need for loyalty offers closer to what they like (68%) and to make the customer feel part of a community within the brand (52%).

Brand coalition preference drivers

Brand coalitions could also help to combat the feeling consumers sometimes experience that it takes too long to earn rewards from brands.

Personalisation

To successfully build more personalised brand collectives and offers to engage customers, brands will need the data to understand and analyse who they are, their needs and behaviours.

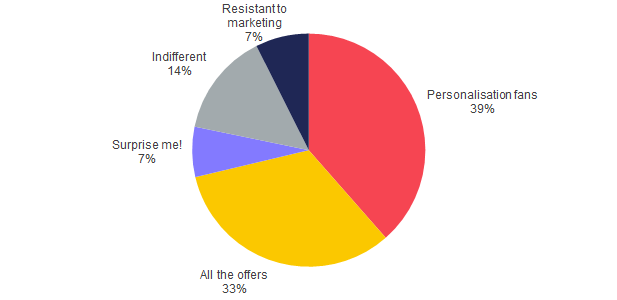

The majority of consumers appear to welcome some form of data-driven personalisation of the offers they receive. Indeed, according to a segmentation of consumers based on their marketing preferences two-fifths (39%) of consumers fall into the ‘Personalisation fans’ group, who particularly like offers that reflect their tastes and interests instead of being random. A further third (33%), named ‘All the offers’, appreciate personalised offers as well as those that are more random or surprising. The remaining consumers fall into other segments that do not favour personalisation.

Personalisation segmentation

This broad positivity for personalisation is encouraging for brands wanting to engage their existing customers, as it allows businesses to expand what they know about their consumers and deliver the personalised touches their audiences crave. When built into a loyalty programme, this can add an extra layer of relevancy and value that consumers are looking for from loyalty schemes.

For brand coalitions, from a data perspective, the ability to share customer data across brands would be required to make this loyalty programme model truly and effectively personalised.

Strong connections

Building coalition systems will require brands to form strong mutually beneficial partnerships able to guarantee benefits to all the organisations involved. These goals may be different – whether it’s acquisition, engagement, loyalty or simply spend, all brands should be able to succeed.

For this reason, ‘True Coalitions’ are particularly challenging to form, as they require all parties to put into the partnership with the inherent risk, they could receive less back. This is also why we are currently seeing many more ‘Partnership’ and ‘Intra-‘ coalitions, as these are built around a single brand or business that can lead and, as such, be the main beneficiary.

Nevertheless, consumers are clearly open to engaging with the coalitions and when strong partnerships can be made there is high potential to strengthen customer engagement.

Questions

- Would a brand coalition offer more rewards to your loyal customers?

- Do you currently have brand relationships in place? Do you know if your customers like these other brands?

- Which brands would your customers like to receive rewards from?

- Could brand coalitions offer an opportunity for growth? Which brands could facilitate this?

- What common ground could you build with these brands? What are the objectives of your loyalty scheme?

- What are the next steps towards a ‘True Coalition’?

Takeaways

So how do you make brand coalitions, whichever form they take, work for your organisation?

1) Make rewards tangible

Brand coalitions offer the opportunity to fight against the feelings that rewards take too long and are not tangible enough to inspire customers to earn them. For instance, points-based systems can all-to-easily fall foul of these challenges by not clearly connecting to the benefits a customer can earn, whether that’s in the short- or long-term.

Ensure your customers know what they’re earning, how they’re earning it and where they can ultimately redeem it – especially within a coalition setting.

2) Make rewards relevant

Customers like personalised offers from brands, whether in part or in full, meaning they’re willing to share their data in the pursuit of this relevance. When built into a coalition and/or loyalty programme, this can offer a new layer of value that customers are searching for. But if not delivered on, this could have an equally detrimental impact.

Ask your customers what they want and if you make promises (particularly about their data), be sure to keep them.

3) Build relationships

From a data protection perspective, the ability to share customer data across brands is required to make sure brand coalitions are truly and effectively personalised. This is impossible without strong relationships in place, both with the consumer (as already mentioned previously) and fellow brands.

Embark on coalitions with brands that not only offer opportunity but hold to the same privacy standards as your own. Otherwise, you risk building relationships on unstable foundations.

Case Studies

Here are a few examples of how brand coalitions are already offering benefits to both businesses and their customers.

Marie Claire's Beauty Drawer: Free personalised beauty samples

DonatePal: Multiple charity donations in one go

Simply Be Perks: A loyalty programme designed for Millenials

Avios: Points can take you to your destination

Methodology

‘Future Trends: Power of Brand Coalitions’ is an initiative undertaken by the DMA in collaboration with dotdigital and partnership with Foresight Factory.

The report partially reviews data from the ‘Customer Engagement: How to Win Trust and Loyalty’. In addition, the DMA Insight department conducted desk research on industry trends, including the use of Foresight Factory’s FFonline platform.

If you have any questions about the insights or methodology used, you can contact the DMA’s Insight team via email: research@dma.org.uk.

Please login to comment.

Comments