PPC Industry Insights: Insurance

12 Dec 2016

So you’ve got a new paid search client, and they sell insurance (car, home, pet, medical, life, professional indemnity, travel, liability – for the sake of this blog, lets lump them all in together). You’ve had a quick look at their account and have had to have a sit down and a cup of tea after seeing CPCs of between £20 and £50 for the top keywords. Already you’re thinking that nice high target CPA might not be so achievable after all. However, as the phrase goes, DON’T PANIC.

Running PPC for an insurance company can be different to other industries, but there’s plenty you can do to improve performance. Read on for a little more insight into PPC for insurance clients, with some tips, tricks and recommendations.

What makes the insurance industry different?

For starters, the keywords are pretty expensive, although other industries (notably gambling, finance / trading, some tech) have higher CPCs.

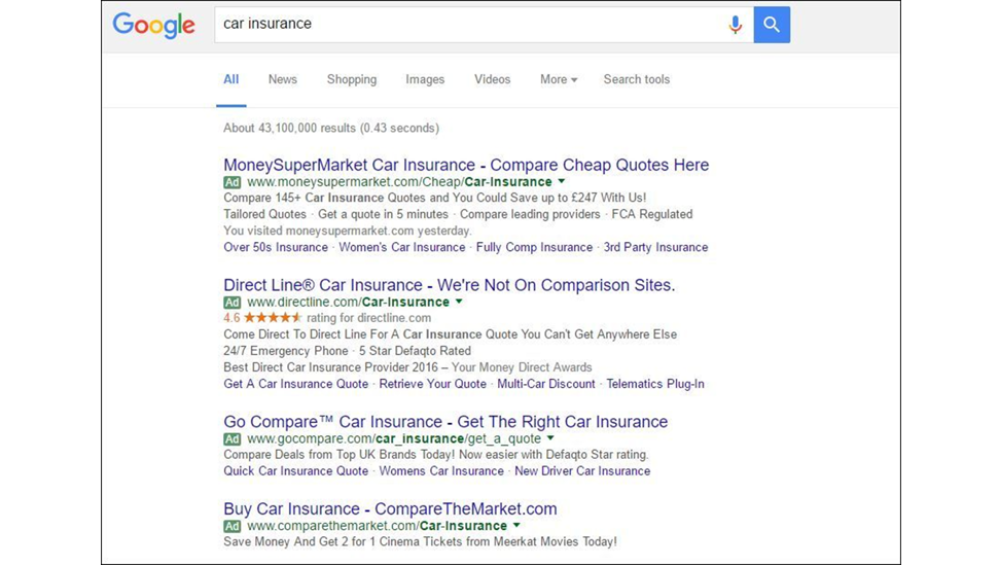

We generally distrust insurance companies, thanks to renewal premiums being so high, which means brand loyalty really takes a hit – present a better offer for the same product and people will switch. There’s also massive amounts of competition within the search results, with the minimum first page bid usually double figures and almost always 4 ads (with the full range of extensions) at the top of the page.

However, the biggest issue for PPC in the insurance industry is the huge amount of traffic going through short tail terms (“home insurance”, “life insurance”) and the looming presence of comparison engines, who regularly take up at least 30% of the results page. These two issues also hit particularly hard when combined - the shorter tail terms are where the comparison engines’ huge budgets can really thrive.

Know Your Product - Limitations of your cover

First things first, what are you selling? OK, yes, insurance, we’ve already established that. But is it bargain basement cover, targeting students wanting to insure their beer stash and second hand laptop for the lowest possible price? Or are you targeting wealthy over 50s who want to make sure that if their £4 million Kensington townhouse burns down in a freak crème brûlée related accident, they can afford to rebuild? This is going to affect whether you’re targeting the bargain end of the market or the expensive but no questions asked full coverage end of the market, or somewhere in the middle.

Also be aware of lower value products and don’t blow your budget on them, even if the CPA is better – a student’s contents insurance policy will be much lower value than a homeowners’ building and contents policy, so make sure you’re either tracking conversion value or have a separate CPA target for different policy types. It’s particularly useful to be able to differentiate between policy types, either using a different conversion tracking code or, if you’re on DoubleClick, using Floodlight variables (also known as u-variables). If you can’t do that, split out your campaigns by policy type and give yourself a target for each individual campaign. You’ll just have to hope that people who search on ‘home and buildings insurance’ won’t decide to just get a contents policy once they have their quote.

Something you should always do when looking for insurance – read the small print. In many cases, there will be a number of exclusions for cover. For example, many pet insurance companies do not cover Shar-Peis, wolf hybrids (of any generation) and any dog breed outlined in the Dangerous Dogs Act 1991, plus a host of other breeds for a number of different reasons. People with these breeds (or with other limitations on their insurance, such as having a classic car, or a house on a floodplain) often know that they are going to require specialist insurance, so will include these terms in their search. If you have a list of exclusions that will never be covered by your policy, add them as negatives to all your campaigns. You know it won’t convert, so why bid on it? Alternatively, if you do offer insurance to people with these limitations, make sure you’re bidding on the relevant longtail keywords. If possible put them all in separate ad groups or campaigns, then shout about them in the ads. People are looking specifically for insurance that covers them, make sure you make it obvious that you have what they’re after.

Although it's not explicitly a limitation, also be aware of the key dates in your calendar. If you're targeting students, make sure you've got big budgets for late August to early October; for most insurance products you'll see the big boost in January after a lull in December, while for travel insurance you'll have a big drop in December and then a steady climb towards the peak summer months. It's worth taking a look at Google Trends to see past search volumes, and also keep in mind any above-the-line marketing campaigns that might impact traffic volumes. There's no point running a big expensive marketing campaign if you don't have the budget to appear on brand terms at the same time.

Know Your Brand - What does the market think of you?

Consider recent TV campaigns, have a look at past news articles (press releases or external sources), speak to internal marketing teams, maybe even conduct some focus groups. Is your brand considered solid but unexciting, or is it considered tech-savvy and down with the kids? This will impact who you’re targeting, as people’s affinities and opinions on your brand will affect how likely they are to even click on your ad.

If the general internal feeling is that your brand is fairly modern, but perhaps that isn’t being communicated to users and you’re losing out because of it; it may time to run a branding campaign – either with traditional media or with programmatic. Make sure you have solid continuity between search and non-search marketing. There’s no point putting out one message on a TV ad or billboard and having something completely different in your search ads.

Know Your Audience - Demographics, pen portraits & remarketing

Tying in with knowing your brand, you also have to know who you want to target, not just who is already familiar with your brand. Once you know who has affinity for your brand, your potential audience should include those people but also anyone who might be interested in your product.

Demographics are a biggie for insurance paid search. Going back to students vs. homeowner, how old are those students likely to be? What about the Kensington homeowner? If you’re selling car insurance, those 18-24 years olds might be very, very lucrative deals for you, but they’re also likely to be hitting the comparison engines to make sure they’re getting the best deal. Older drivers may have lower premiums but if you catch them at the right time with a reasonable price they may be more willing to convert immediately. Take this into account when setting bids and bid modifiers on demographic targeting. However, don't just add adjustments to demographics because you think you know who's who - make sure you're looking at the data to get the real picture.

If your brand perception doesn’t match up with your potential audience, you'll have an uphill struggle, and probably an expensive one.

You can use sites such as Yougov to get free* insights into your users, including the basics of age and gender but also their hobbies and interests. There’s also a paid version available with more information. Alternatively there are a huge range of companies available who can analyse your existing customers to create pen portraits. Once you know who your users are, you can change your targeting appropriately.

*Profiles for specific brands tend to be locked to paid customers only, but you might get lucky.

You’ll need to make sure your audience lines up with your brand, and if it doesn’t then you’ll need to do work to either change how people perceive your brand, change what your product is and who it’s relevant for, or change who you’re targeting. Either way, if your brand perception doesn’t match up with your potential audience, it will be an uphill struggle, and probably an expensive one.

Once you have your audience on a remarketing list, you can then target those people differently as well. Remarketing for insurance doesn’t have to mean following people around immediately after they visit your site. Yes, do try that, particularly if someone has gone to the effort of getting a quote, as you might draw them back in, but that's not all you can do. Get some RLSA lists added to all your campaigns, particularly on your more short tail terms too, to make sure you’re targeting people who are already familiar with your brand. People tend to renew their insurance in yearly cycles, so try some lists targeting people who visited your site between 330 and 390 days ago. Many people will have cleared their cookies since then, but if you have a reasonable volume of visitors then you should still have the minimum 100 users required to show on the GDN, and even the minimum 1000 to use as RLSA lists. You’ll need to prep this well in advance – set up the remarketing lists now in order to use them next year – but it can be well worth your time. You can also use these remarketing lists with Gmail ad campaigns. Try running remarketing campaigns in January when interest in insurance tends to peak.

Consider also using customer match lists to target lapsed users, again at that crucial yearly time frame. You’ll likely already be sending them emails around this point, so make sure you’re tying up those campaigns in terms of messaging and offers.

Know Your Competitors - Where Do You Stand?

If you’re competitive within the market then you can bid on ‘cheap insurance’ to your heart’s content, because you know your conversion rate will be high enough to make it worthwhile. If you know your rates are higher than others in the market, or even if you’re somewhere in the middle, it’s worth steering well clear of ‘cheap’ and ‘bargain’ terms and adding those in as negatives. People keen to buy ‘cheap’ insurance are unlikely to convert on your more expensive product, even with free gifts and more coverage – and if they do convert thanks to these sort of incentives, they’re likely to leave after a year or two, which hits lifetime customer value.

Once you know where you stand within the market, check out what other special offers your competitors are using in their ads. Can you beat that with your own offer? If not, is there some USP you can push that could bring people to your site over theirs? Perhaps information on your outstanding customer service, or your no-quibble guarantee on claims under £200. Don’t just assume you have to compete on price or on freebies, just because everyone else is.

Budgets

The usual advice applies – you should keep spending while your clicks are profitable. In the real world, we’re restricted by budgets.

If you have a ton of budget and need to blow it by the end of the financial year, with no restrictions on CPA, bid on short tail keywords and bring in the huge volume available there, conversion rate will be low, particularly if your offering isn’t particularly competitive, but you’ll certainly get the volume of traffic.

If you need, as most of us do, to hit a target CPA or ROI, then go slightly longer tail, such as “home insurance in London”, “lifetime pet insurance”, “car insurance classic Jaguar”.

It’s worth testing some target and bid campaigns, maybe on those short tail terms, which might be more expensive but work well if people are already familiar with your brand.

If you’re on very low budgets, you can potentially just go for brand bidding, which will definitely have a low CPA, bringing in people you’ve already spent money on instead of allowing them to go to competitors. You could even exclude existing customers to weed out people just looking for a phone number. If you’d rather spend on generics, go for the very long tail such as “home insurance for house with conservatory”, or “car insurance classic E-type Jaguar”, where you know CPCs will be low and you’ll get a good conversion rate, even if the volume is very low.

Ideally, you’d build out long tail keywords for all aspects of your product, but this can result in a very bloated account if you’re not willing to keep things tidy, so stick to phrase match and go for the middle ground if you can afford it.

Legal Compliance & Ad Copy Restrictions

One of the biggest issues with insurance marketing is the need for legal compliance on all copy and creative. You have to make sure you’re sticking to the guidelines laid down by the FCA, because if they decide you’re not following the rules, they can give the insurance company a hefty fine. This can mean adding qualifying data to any cost claims, such as “25% of new customers paid less than £200 per year” – in some cases even adding in additional date information such as “as of June 2016”. This really eats into your character count, but in most cases can’t be avoided.

Most insurance companies will have a legal department who will need to sign off on any marketing before it goes live. They tend to be busy people, so if you have a very fixed deadline it’s worth getting any ads sent over well in advance (weeks or even months) to ensure everything gets through the system in time. Also make sure you have a copy of their guidelines to reduce the number of amendments required.

It’s Not All About Google

Everyone in search tends to be quite Google focussed, but given the massive CPCs and the amount of competition for insurance on Google, it’s worth taking a look at some of the other options available.

Bing – at least cover the basics, get that brand campaign copied across. Don’t let competitors steal your potential clients. Bing has ticked up above 20% market share in the UK this year, so that’s a big chunk of the market you could be ignoring. It’s also a chunk of the market that many companies ignore, so CPCs and competition tend to be lower. Demographics also vary here, with Bing tending to be skewed older, so consider whether this suits your product.

Yahoo Search – Back in January, Yahoo Search (and partner sites) had 12% of the US search market share. As with Bing, low CPCs and lower competition are key, and even fewer paid search resources are focussed here, so you may get a low volume of cheaper conversions. Bear in mind that this is currently only available in the US - Yahoo Search in the UK is covered by Bing Ads.

Gemini – 23% of impressions on Gemini are for finance / insurance clients, with an average CPC of just £0.08. This is even lower than the Gemini average (£0.10) and can bring in some really strong returns both post-view and post-click. You can use remarketing or lookalike audiences, target people with an interest in buying a new car or home, or even target people based on the type of apps they use. You have less control over Gemini than you would have for Google / Bing, as it’s based on page theme rather than exact or phrase match keywords, but you can often bring in strong performance all the same.

Gmail – yes it’s a Google product, but it’s a part of AdWords that can get ignored. Target based on renewal or insurance quote keywords, or use the newly-introduced in-market segments. There are even separate in-market segments for specific types of insurance.

Site Changes & Conversion Rate Optimisation

Everyone hates filling in forms. Minimise the number of fields people have to fill in to get a quote, then only give them the extra forms once they’ve decided the quote is right for them. By frontloading all the information requirements, you get more information from those that complete all the forms, but people are less likely to convert and will never even see the cheap quote you could offer them. Quite often this isn’t within the remit of paid search, but it’s a recommendation you can put forth anyway. Make sure you're really working to increase your conversion rateand running tests to improve your landing pages and conversion journey.

Do some analysis on cross-device attribution. People will be even more reluctant to fill out forms on mobile, but is there some way of getting a quick quote that you can offer them? Will they start off on mobile and have a quick look at your summary pages, then convert on desktop later on? Make sure you make it as easy as possible for people on mobile and tablet devices, as these tend to be where CPAs escalate. If you know your mobile journey is awful, and you can’t see much cross-device activity, consider whether you want to pause mobile altogether and move that budget elsewhere.

Summary

- Clicks are expensive but are they outweighed by the amount your searcher will pay you for car insurance? Not just for this year’s policy but for however long they stay with your brand. Be aware of lifetime value.

- Only target short tail keywords if you can afford it and if your offering is good enough to compete.

- Add anything you explicitly don’t cover into a negative keyword list.

- Long tail keywords can work, as long as they truly are relevant to your product.

- Track policy types and have different targets based on product and lifetime value.

- Make sure that how your brand is perceived is aligned with the affinities of your target audience, and if it doesn’t align then be prepared to spend a lot of money changing perceptions (or change your target audience).

- Prep things way in advance to get around compliance problems.

- Try out Gemini and make sure you’re covering the basics (at least brand!) on Bing; consider Gmail and other display networks.

- Improve your on-site customer journey and closely examine mobile performance.

- As always, DON’T PANIC!

Do read this blog written by Katie Rocker on the Periscopix website, please click here.

Please login to comment.

Comments