Can customer journey analytics improve conversions?

27 May 2021

Customer journey analytics can tell us some of what we need to know about the routes customers take, but does it help us to improve conversions?

What is customer journey analytics?

Customer journey analytics is the science of analysing customer behaviour data across multiple touchpoints, and over time, to measure the impact of customer journeys on business outcomes.

Companies use customer journey analytics because it is an effective way to improve customer experience, increase customer lifetime value, and improve customer loyalty.

Let’s start then with what we mean by the ‘journey’.

This can be used to describe a myriad of different routes from just travelling around inside a brand’s website, to trekking between websites and mobile applications, to flipping between online and offline channels, or to contacting a call centre.

Indirect channels like TV and press may also play a part, and, least trackable of all, conversations actually take place between people.

So, let's dispense with one myth, that customer journeys are always trackable, as some of them are not at all, and others only partially. For instance, only a tiny proportion of retailers attempt to collect emails or other contact details from customers in their stores, and, when they do, many refuse. Some retailers use ‘beacon’ technology to understand if the customer is a repeat visitor or new; however, matching this back to the customer has raised some privacy concerns.

The extent to which we can join together the stages in the journey is entirely dependent on the evidence by way of personal identifiers that the visitor leaves behind at each stage, and how they can be linked.

For instance:

Email marketing identifies which customers have opened and/or clicked from each campaign. Direct mail provides the details of who has been sent a catalogue, however not if they received it, or even browsed it.

Call centre tracking identifies the number you are calling from.

Website analytics captures the cookie ID of website visitors, how they got to the site, and whether that was through search, direct visit or referral from another online channel like social or paid digital.

Tracking is one thing, but then linking events together is another. To do so one needs to form associations between personal identifiers. A cookie ID becomes much more valuable when linked to an email or a mobile number. An email is more valuable when it is associated with a postal name and address, and so on.

All customer journey analytics relies on being able to link stages in the journey using identifiers that can be matched up. The most obvious case where external links don’t exist are unidentified browsers, where one browsing visit can be linked to another, but not to anything that is going on in the offline world, or in other websites.

We must accept that customer journey analytics can only deliver a partial truth, but this is not to deny that a great deal of value can still be obtained from it.

Visualising customer journeys using analytics

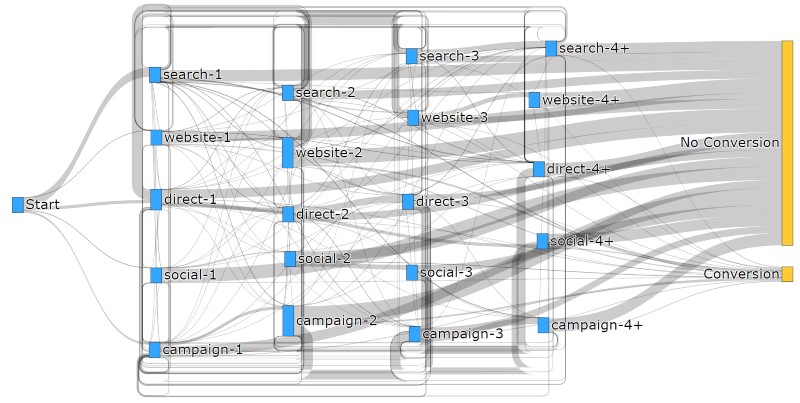

We can depict these customer journeys using what is known as a Sankey diagram, named after Captain Matthew Sankey.

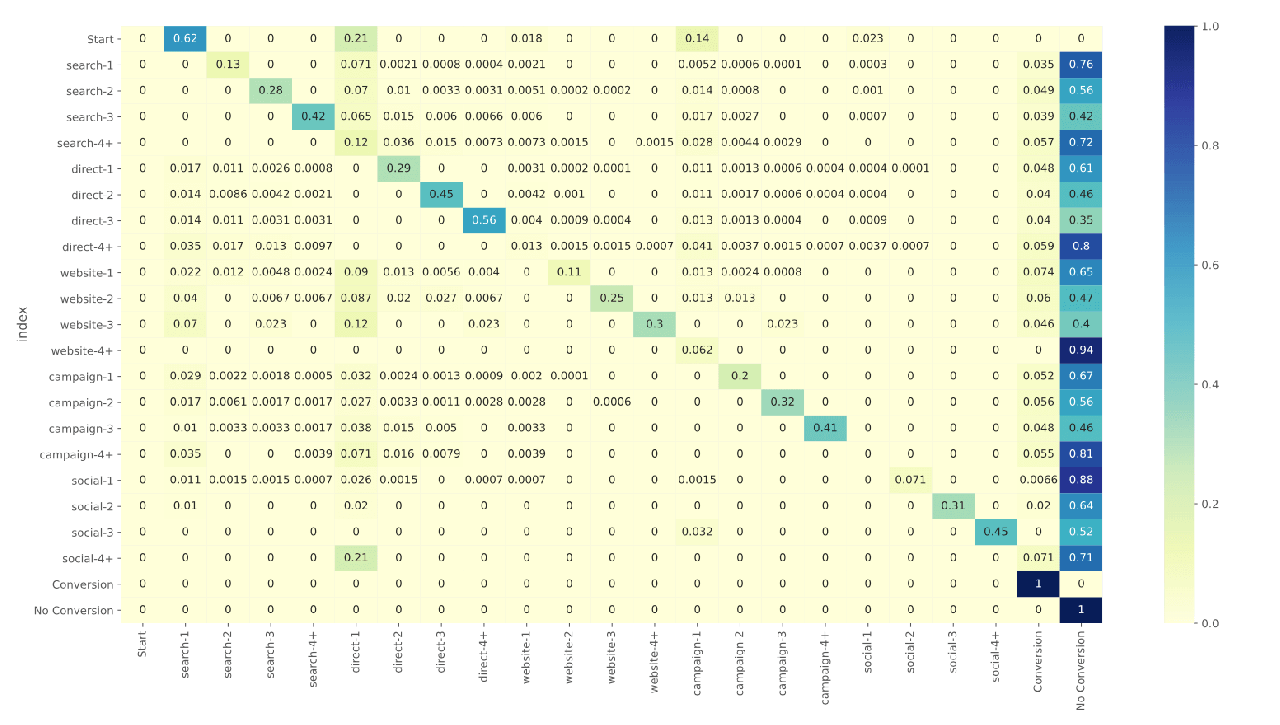

Alternatively, with a numerical version of a Sankey diagram, like the one below, we can start to understand what the probability is of customers moving onto another stage in the journey, or making a purchase.

To understand this chart, start with a channel on the left and read across to find the probability of moving from that point to the next channel (column), or to making a purchase (described as conversion), or to nothing further being trackable on the customer journey (described as null).

Improving conversion rates with customer journey analytics

So, what can be done with the information in a chart like this?

- It brings a sense of reality. If you know that the probability of moving from social media to a sale on your website is five per thousand, you will take a more sober view of media owners’ claims.

- It provides a really useful comparative understanding of the impact of different channels. In this example the chances of purchasing after receiving and opening a series of four emails (described as campaigns) is 6%, whilst after four direct entries it’s 5%.

- It explains the benefit to be gained from multiple experiences in the same channel. The chances of purchasing after a fourth consecutive search is 2.4 times greater than a conversion following a single search.

- It shows where the interactions between channels are more likely to happen. For instance, the chances of moving from receiving a fourth email campaign to undertaking a direct search are 12%, compared to 5% after receiving just one.

- It also shows us which are the better channels from which to start the journey. In this case starting with an email campaign opening is best.

These are just examples of some of the uses of visualising a customer journey, and you will want not just one but multiple views. For instance, new customers will have very different journeys to returning ones, and so will people from different countries, or those buying expensive merchandise compared to those buying something cheaper.

Most organisations struggle to understand their impact on customer experience, and the value which can be generated from enhancing it, due to several reasons:

- The number of customer touchpoints and the volume of data produced by multiple channels and devices has exploded in recent years. Having this in one place becomes a challenge.

- Data silos lead to problems of data mismatches, missing and bad data and, time to transform and aggregate the data.

- Shortage of skills and resources to analyse and make sense of the data, as it often requires skilled data scientists and analysts who are conversant with programming languages like Python, R or SQL.

- Inability to attain rapid customer insights, and execute triggered activity across multiple channels, can have negative consequences if you’re not aware of each customer’s experience with your company across channels.

Now, your customers expect every interaction with your organisation to reflect the context of their entire experience regardless of which touchpoint they use next. So how do you meet these expectations?

Overcoming these obstacles and making journey-driven decisions for each customer at scale

You are probably now in need of an explanation of how you can start to understand your customer journeys, visualise the data, and make use of it?

We recommend first introducing, if you don’t already have one, a customer data platform into which the data describing different parts of the journey can be ingested, and linked together wherever identifiers can be matched. A typical customer data platform will take in data from your email service provider, your website, your transactional or ecommerce systems, paid digital and possibly your call centre and your retail outlets. Your objective will be to ingest as many parts of the customer journey as possible.

The customer data platform will then undertake what is known as identity resolution to join as much data to individuals as is possible.

(Incidentally the customer data platform will have multiple other uses than customer journey analytics, although this remains a key element of what it can deliver).

With this in place, you have the potential to build a table of all the visible and linkable events that precede each transaction. As long as these are date-stamped, technology can then provide you with the journey charts that you will require to help plan your direct marketing.

Most companies lack the comprehensive, up-to-date journey data needed to optimise each interaction, so they are forced to run experiments on single channels, such as email or website, without understanding their wider impact. By having a single view, real-time data visualisation and the ability to trigger activity based on events, you can see how customers respond to each improvement as your customers experience them.

We have developed this capability inside the UniFida customer data platform, so that for any time period, and any segment of customers, the production of this kind of analysis is automated.

This article was written by UniFida's founder and director Julian Berry.

Please login to comment.

Comments