Coronavirus: Understanding Consumers in 2021

03 Feb 2021

How are UK consumers surviving the latest lockdown? How has their behaviour changed over the last 12 months? What does it mean for brands and what should (or shouldn’t) they be doing to better engage customers?

These are all questions covered in the latest insights from the team at Kantar in its recent ‘COVID-19: Understanding consumers and brands in 2021’ webinar. Overall, 2020 has clearly impacted consumer behaviour in so many ways, but as part of that it has also broadened established disparities in society too. In turn, this is driving some of the growth in division and friction we’re seeing in the society too.

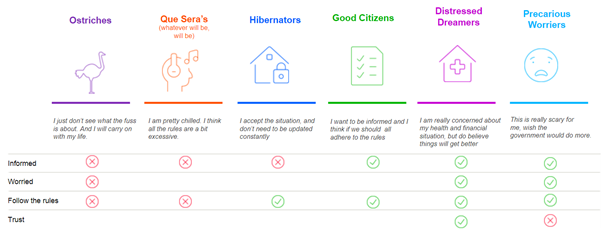

Winnie Cheng, Senior Client Lead, Insights at Kantar, shared the latest update on their consumer segmentation (see below), which was created by analysing the level of concern about the pandemic against the frequency consumers seek out information.

Kantar’s Covid-19 Segmentation:

The most recent results reveal the six groups formed back in July 2020 have remained notably consistent into January 2021, although with some notable shifts. There has been a slight decrease in the proportion of consumers in the ‘Ostriches’ and ‘Que Sera’s’ groups (11% to 9% and 19% to 16% respectively). Meanwhile, the ‘Precarious Worriers’ group has seen an increase from 11% to 16% over the same period.

Most consumers have felt some level of personal economic impact as a result of the current conditions too, rising to 44% from 37% in April 2020. This is also something felt significantly more by consumers aged 25-34 years-old (60%), as well as the ‘Distressed Dreamers’ (51%) and ‘Ostriches’ (49%) groups.

The level of anxiety and stress have both increased since the summer of 2020, now respectively at 38% and 36% for all consumers. Meanwhile, those feeling relaxed, have fallen to just under a quarter (24%).

Despite some disparities, consumers with a high level of anxiety are more likely to be women, aged 35-44 years old, and part of the ‘Distressed Dreamers’ or ‘Precarious Worriers’ groups. On the flip side, the relaxed consumers are male, over 65, and significantly more likely to be part of the ‘Hibernators’ or ‘Good Citizens’ groups.

Shifts in consumer behaviour

Beyond the emotional toll brought by the current conditions, this last year has fuelled some dramatic shifts in consumers’ behaviour. From the shift in spending on food and drink in the home and record year for take-home grocery shopping, to the online switch that represents the first major shift in shopping habits in a decade.

However, as Andrew Walker, Client Knowledge Director, Worldpanel at Kantar, pointed out, 2020 saw a penetration for online shopping rising from 28% to 39%, these digital channels still only represented £1 in every £9 purchased. So, while 10% fewer physical trips were made in the last year, these didn’t all go online as baskets were also 20% larger.

Whether this shift will remain is one of the questions many brands want the answer to in 2021. Meanwhile, brands need to continue to be agile and reactive in the short term while trying their best to play for what the future might look like.

Rather than the usual ‘do’s’, interestingly, Adele Joliffe, Head of Brand Consultant Team at Kantar, decided to leave viewers with three ‘don’ts’:

- Don’t change everything - double-down on your meaningful difference

- Don’t think sustainability is taking a back seat - take care with where and how to play

- Don’t forget the keys to making every penny count - however you’re investing in 2021

All the insights from the Kantar team are available here:

COVID-19: Understanding consumers and brands in 2021

For the DMA’s latest insights into what’s driving consumer loyalty amid the pandemic, why not read the ‘Customer Engagement: How to Win Trust and Loyalty 2020’ report. Or if you’d like to look forward to the trends shaping 2021, follow the Future Trends 2021 series.

Please login to comment.

Comments