Healâs Furniture: A Tale Of 2 Ad Types, Text Vs. Shopping

05 Mar 2015

Heal’s has been designing, making and selling quality furniture since 1810. Periscopix has been working with them for many years now to drive their digital strategy forward.

Testing generic keywords can be troublesome for any client, but those that sell high-end products can find it even more difficult. Before Product Listing Ads/Google Shopping, Heal’s was spending most of its marketing budget on search text ads, trying to capture consumers who weren’t looking directly for their brand.

Today’s article showcases the company’s transition to pushing more of its budget into Google Shopping and the measures of success it has seen from this transition.

The Story So Far…

The Heal’s strategy has always on brand terms and generic terms, including product categories, brands and items through standard search text ad advertising. In January 2013, Product Listing Ads (now Google Shopping) were launched in the account, and the battle for where was best to spend budget began.

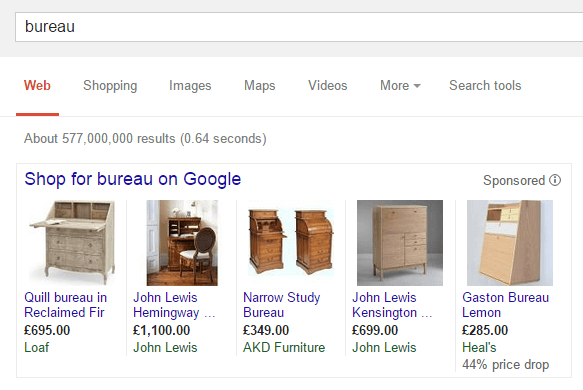

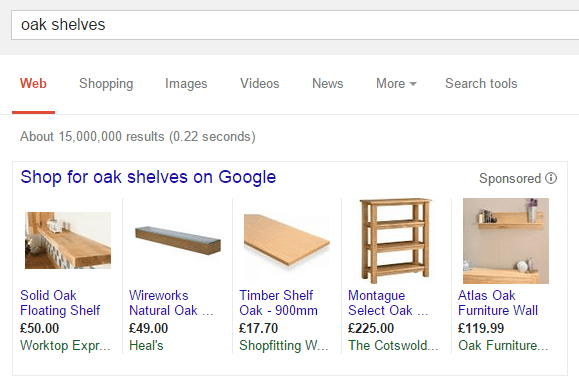

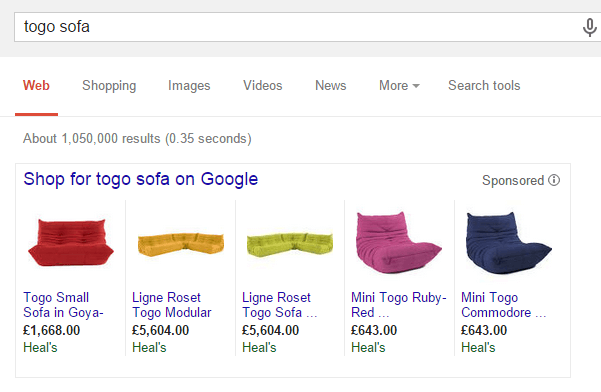

Heal’s had previously found it expensive to try to gain attention from generic terms (such as “bureau” and “oak shelves” below), and appearing in the banner when the user was not necessarily at the final stage of their search journey wouldn’t always yield good results. With Google Shopping, they’ve been able to showcase more of their products to users across their purchase journey, and this has proved more successful in gaining conversions.

In addition to this, due to the higher price points their designer items, a certain percentage of people will prefer to go into the store to see the product and will eventually purchase there. The purchase cycle for these kinds of items is often longer, but it’s important to grab the buyer’s attention visually at an early stage.

Shopping ads have helped Heal’s show how great its items look in a way that it wasn’t able to describe within the search text ads.

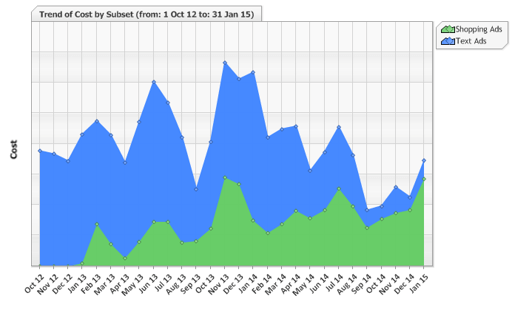

I’ve excluded the search text ads brand data from the following charts as I wanted to focus mainly on the search generic activity and the shift in that.

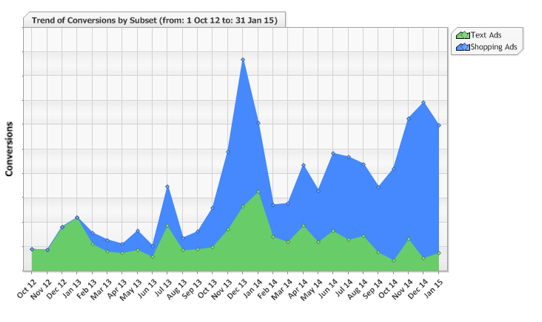

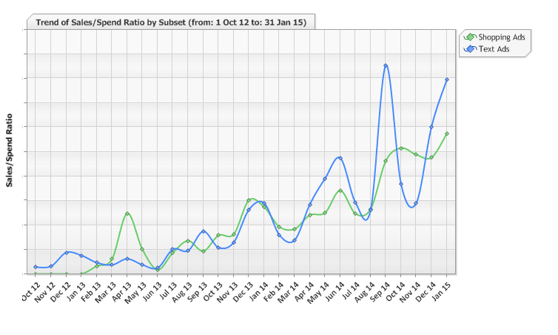

You can see from the chart below that initially, budget was spent primarily on text ads. Over the past couple of years, as budgets have changed, the shift toward spending more of the budget on Shopping has increased heavily for non-brand activity.

Where budgets scaled back year-on-year, we’ve still been able to bring in greater conversions for Heal’s by pushing the budget into Google Shopping, where the cost-per-click is (in most cases) cheaper than advertising on the same terms with search text ads.

The Sales/Spend ratio has been on the increase for Google Shopping through optimization, especially as Google has advanced its platform to allow us to be more granular with bidding strategies.

Even with products where there would be no other search text ads competition, Heal’s is finding that these visual shopping ads are proving much more successful in getting people’s attention.

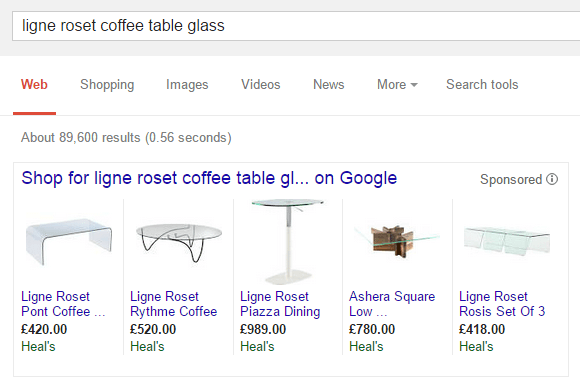

One of the issues that Heal’s has with generic search terms is that its price points can often be higher than other companies selling desks, lights, etc., because its products are designer. The added benefit of showing the price and style of its items, and appearing more than once, has been one of the keys to success resulting in higher conversion volumes.

Even better is the example below. Not only does Heal’s dominate the entire Shopping area, but the only other competitor’s search text ads are showing at the bottom of the page.

Shopping Brand Vs. Text Brand

Brand search queries can trigger both search text ads and Shopping ads, depending on how your account is set up. This leads to the question: Which type of ads perform best for brand?

When comparing the two, the higher volume of sales still come in from the solo brand name term via search text ads, as no Shopping ads appear when you search for just “heal’s.”

However, there are some interesting differences between search text ads and shopping ads behavior when terms get a bit more niche.

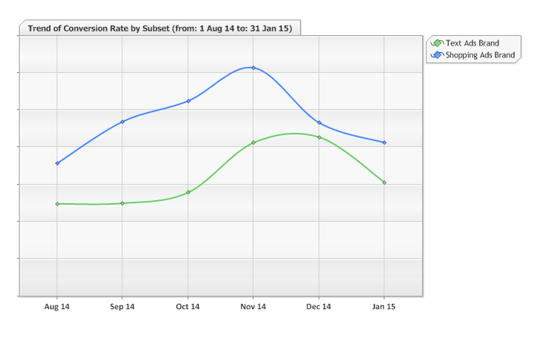

Over the last three months, conversions rates have been, on average, 26% higher for shopping ads vs. standard text ads when it came to brand name related search queries.

I thought it would also be interesting to look into average shopping basket values and if they differed on brand searches between the two types of ads; the results followed a similar trend, with shopping only slightly yielding a higher average.

Cost-per-click from shopping brand ads, on average over the last three months, has been 23% lower than the search text ads, which just shows how you can save money and increase conversion rates at the same time through optimization on Google Shopping.

The Moral Of The Story

Constantly analyze where it’s best to be spending your budget and don’t be afraid to push for one ad type over another if you’re able to see more success from it.

To view the article written by Periscopix's Associate Head of Search, Rebekah Schelfhout, please click here.

1.png)

Please login to comment.

Comments