FMCG brands turn to door drops

07 Dec 2011

FMCG brands face increasingly challenging times, as consumers tighten their belts and a relatively small group of powerful retailers tighten their firm grip on the shopper relationship. This sees FMCG brands looking at other ways to reach shoppers with incentives, such as door drop sampling.

FMCG brands losing out in retailer price wars

Price wars are a cornerstone of retailers’ strategies, even if they are often against their own interests. They squeeze their margins, and challenge their infrastructures as they expand their ranges into a variety of more profitable non-grocery sectors.

FMCG suppliers are also compelled to devote large percentages of their allowable marketing investment to price promotions. Deep-cut-promotion strategies such as Buy one get one frees (BOGOFS) are everywhere. It takes a brave retailer to opt for everyday low pricing (EDLP) rather than deep cut promotions such as BOGOFS.

For brands, EDLP would perhaps provide a more stable environment. At the very least it would allow them to engender whatever loyalty they can muster, rather than being one part of a shopper’s repertoire where the choices are based on which product is cheapest this week.

The challenge facing FMCG brands

How can FMCG brands maintain their brand status in a world that focuses on price? The whole idea of a brand used to be the ability to sustain a premium price and deliver improved profits through investment in brand-building marketing. Today, the benefit of investing in a brand is to sustain sales during a continual price war while minimising the discounts you are forced to fund by your retail customer.

What FMCG brands can do

FMCG brands need to deflect attention from price by continuing to invest in brand positioning marketing. Online and social media sites are also worth exploring as they will enhance the brand image. And, if nothing else, it will ensure brands don’t get left behind in some, as yet largely unrealised, online revolution.

The trouble remains that brands need to drive people to make purchases and they need to drive retailers to support their brands – even if that means getting the merchandising right and demanding a bit less in terms of trade promotions.

There is a body of academic work by the Ehrenberg-Bass Institute and others which explores the nature of shopper behaviour. A key conclusion is that brands need to grow by driving trial. This is partly because there are limits to how much stuff you can sell to any one shopper. But, more importantly, building their shopper base allows any marketing investment to have an effect on a bigger pool of shoppers who have at least experienced a brand and can be nudged into buying it again.

That said, brands cannot live by trial alone; the same academics would suggest that we are all in varying states of lapsing, from the moment we leave the store. Some shoppers will be pretty committed to a regular purchase, some will wait until the product is back ‘on deal’, some will simply make their next decision based on a cumulative effect of competing brand and retailer messages.

Brands need to be able to influence shoppers during the re-purchase decision-making process and there are many tools that aim to achieve this.

How data-driven door drops help FMCG brands

Door drops offer a creative freedom within a targeted environment that no other media can deliver at such a low cost. In some ways, they are perfect for FMCG where margins and shopper-lifetime-values are relatively small because they need to reach large audiences cheaply and with a compelling message. Free coupons work extraordinarily well as well as other less powerful discounts.

It is always interesting to see media come full circle, like fashions it seems that people re-invent things for each new generation – the only change when it comes to door drop sampling is technology. Technology means that even though we come full circle we can re-discover good ideas and make them better than before.

For instance, proprietary planning tools developed by Tangerine help brands create data-driven door drops. These tools explore the interaction between shoppers and retail locations, helping brands plan and evaluate shopper activation and store activation activity.

So why this route now? Clearly, giving physical samples encourages trial (not commercially registered trial in that they haven’t bought anything) but ‘trialists’ are then susceptible to marketing activity in ways they weren’t before they experienced the product. The jury is out in terms of whether sampled shoppers actually go on to buy more than they otherwise would – though there are evaluation processes in place to measure the long-term effects.

Standard door drop coupons remain the best way we can see for driving commercial trial and sales volumes but the long-term impact of sampling delivered in this way is potentially very interesting.

Door drop sampling is an extension of the creative experience; it has to be balanced in terms of cost and effectiveness like anything else but now that it is possible to build targeting models from a postcode level, marketers can minimise wastage (see the slides below).

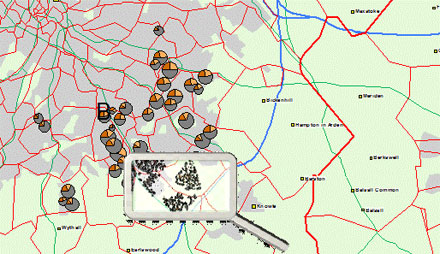

A targeted two-stage sampling campaign was measured at the Microsector level (Microsectors are a proprietary distribution area developed by TNT Doordrop Media Ltd). Shopper responses are shown in Fig 1 by the two shades of orange in the pie charts; the more orange, the better. It is clear that some Microsectors were better than others.

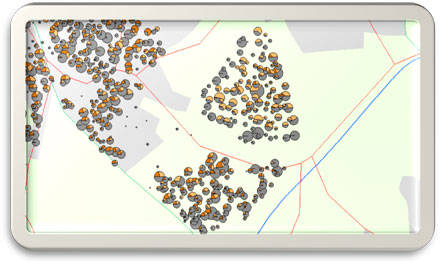

If we look more closely (through the magnifying glass) we can see more detail (Fig 2).

Fig 1

Here, we are looking at postcodes. It may be hard to see exactly, but the variances between orange and grey are much greater. Indeed, there are great swathes of grey where little or no response was seen – it would be relatively easy, with some analysis, to exclude these types of households from future activity by building bespoke rounds from a postcode level.

Fig 2

As any FMCG brand marketer would tell you, anything that delivers shoppers into a brand has to be worth testing. And crucially, we can measure almost anything in this media, so we can learn and improve and learn and improve and… well you get my point.

James Sherwin, Director, Tangerine