RFM modelling - easily generate successful customer segments

02 Sep 2019

RFM (Recency, Frequency, Monetary) analysis is a proven marketing model for behaviour-based customer segmentation. It groups customers based on their transaction history – how recently and how often they bought, and how much they spent.

It enables the marketer to divide customers into various categories or clusters who are more likely to respond to promotions or future personalisation services.

RFM has its roots in Direct Marketing

Bult and Wansbeek originally introduced the concept of RFM in 1995. It was used effectively by catalogue marketers to minimise their printing and shipping costs while maximising returns.

The advent of computers made it even easier to perform RFM studies because customer and purchase records were digitised, the logical progression was to take these catalogues online to become websites. An extensive study by Blattberg et al. in 2008 proved RFM’s effectiveness when applied to marketing databases. Numerous other academic studies have also validated the use of RFM in reducing marketing costs and increasing returns.

The power of three

We all know that valuing customers based on a single parameter is flawed. The biggest value customer may have only purchased once two years ago, or the most frequent purchaser may have a value so low that it is almost not profitable to service them.

One parameter will never give you an accurate view of your customer base, and you’ll ignore customer lifetime value.

Calculate the RFM score by attributing a numerical value for each of the criteria. The customer gets more points if they bought in the recent past, bought many times or if the purchase value is larger. Combine these three values to create the RFM score.

This RFM score can then be used to segment your customer data platform (CDP).

Customer Segments using RFM Modelling

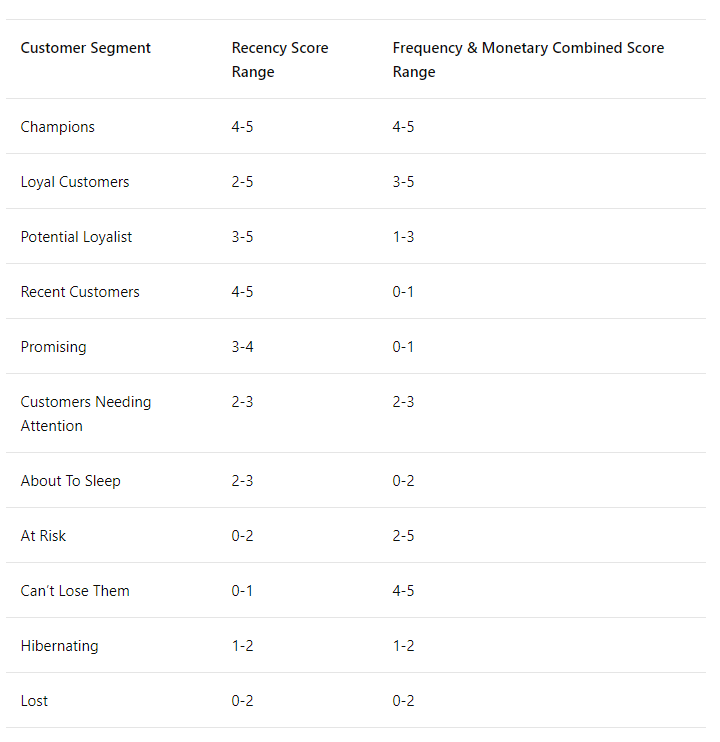

Analysis of the customer RFM values will create some standard segments, a table of suggested segments is listed below.

Think about what percentage of your existing customers would be in each of these segments. And evaluate how effective the recommended marketing action can be for your business.

This RFM segmentation will readily answer key questions for your business:

- Who are my best customers?

- Which customers are at the verge of churning?

- Who has the potential to be converted into more profitable customers?

- Who can you view as lost customers?

- Which customers must you retain?

- Who are your loyal customers?

- Which group of customers is most likely to respond to your current campaign?

RFM Score Calculations Simplified

RFM values - to calculate the RFM score you will first need to identify each customer’s RFM values.

Recency (R) – period since last purchase.

Frequency (F) – number of transactions.

Monetary (M) – total money spent, often called Customer Lifetime Value (CLV)

An example customer may then have an R-value of 1 week, F-value of 5 transactions and an M-value of £2,567 (CLV).

Applying RFM score formula

Once you’ve identified and assigned the RFM values from the purchase history, you can calculate a score for recency, frequency and monetary values individually for each customer.

There are two common options for ranking the RFM values on the scale of 1 to 5:

OPTION 1: SIMPLE FIXED RANGES

Example: If a customer purchased within the last 24 hours, assign them 5. In last 3 days, score them 4. Assign 3 if they bought within the current month, 2 for the last six months and 1 for everyone else.

Therefore, the range for each score has been pre-defined. Range thresholds are based on the nature of the business. You would then define ranges for frequency and monetary values in the same way.

You should choose criteria that are relevant to the purchase cycle and product value, e.g. an M-value of £2,500 might seem high, but if you sell holidays at a minimum purchase value of £2,500 it’s not out of the ordinary.

This scoring method depends on the individual businesses – since they decide what ranges they consider relevant and appropriate.

There are limitations with this option, as the business grows score ranges may need frequent adjustments. What you thought was a high frequency or monetary value in 2017 may be quite different in 2018 once you analyse the data.

This may cause problems with how you deal with your previously high-value customers if they are relatively no longer as valuable as they once were. They may now be incorrectly in the top tier of your loyalty programme.

OPTION 2: QUINTILES – MAKE FIVE EQUAL PARTS BASED ON AVAILABLE VALUES

Quintiles are like percentiles, but instead of dividing the data into 100 parts, you divide it into 5 equal parts. Quintiles work with any industry since the data itself defines the ranges; they distribute customers evenly.

Ultimately, you will want to end up with 5 bands for each of the R, F and M-values, this can be reduced to bands of 3 if the variation of your data values is narrow.

The larger the score for each value the better it is. A final RFM score is calculated simply by combining individual RFM score numbers. There are two ways to do this:

1. Addition - this is achieved by simply adding the three scores together, e.g. Mr Jones has a Recency score of 4, a Frequency score of 2 and a Monetary score of 5. His RFM score would then be 4+2+5=11. By using this methodology, the maximum value would be 15 and the minimum being 3.

2. Concatenation – this is achieved by linking the three scores together, e.g. Mr Jones has a Recency score of 4, a Frequency score of 2 and a Monetary score of 5. His RFM score would then be 425. By using this methodology, the maximum value would be 555 and the minimum being 111.

The Hive Marketing Cloud Customer Data Platform allows the user to choose either option to grade the RFM values using either fixed or dynamic decoding of the data.

Utilising the RFM Data

There are many different permutations of the R,F & M scores, 125 in total, which is too many to deal with on an individual basis and many will require similar marketing responses. The solution is to segment using the standard 11 personas we suggested earlier.

Each customer is placed into their corresponding segment based on their scores. Frequency and Monetary value are combined to reduce the possible options from 125 to 50. It is logical to combine these as they both relate to how much the customer is buying. Recency is more about customer re-engagement levels.

The table below shows the destination segments along with the target ranges for Recency and combined Frequency/Monetary scores.

Applying RFM Segmentation to your business

In the brave new world of the Customer Data Platform and email marketing automation, it is possible for a business to use the above segmentation to create automated journeys that nurture customers with relevant and contextual messages that help grow their Lifetime Value and Brand Engagement.

RFM analysis helps your business optimise its marketing operations: better email marketing, higher customer lifetime value, successful new product launches, outstanding user engagement and loyalty, lower churn rate, better ROI on marketing campaigns, success in remarketing, a better understanding of your business, overall higher profits and lower costs.

Summary

RFM analysis was first created to optimise spend for direct marketing so that expensive catalogues were not sent to customers who would not convert, and this can now be leveraged in today’s omnichannel marketing.

Knowing who is most likely to respond to certain messages allows efficient assigning of budget and identification of the next best action required to optimise Customer Lifetime Value (CLV).

The Hive Marketing Cloud includes out-of-the-box RFM analysis for your business so you can hit the ground running if you want to leverage your segmentation to grow customer engagement and value.

Please login to comment.

Comments