2014 Gold Best Use of Email Marketing

14 May 2015

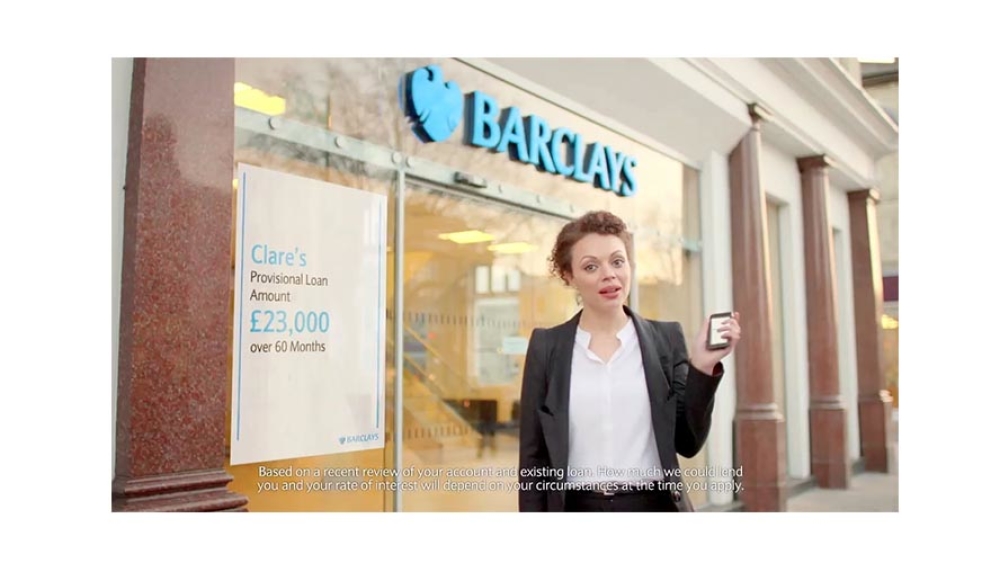

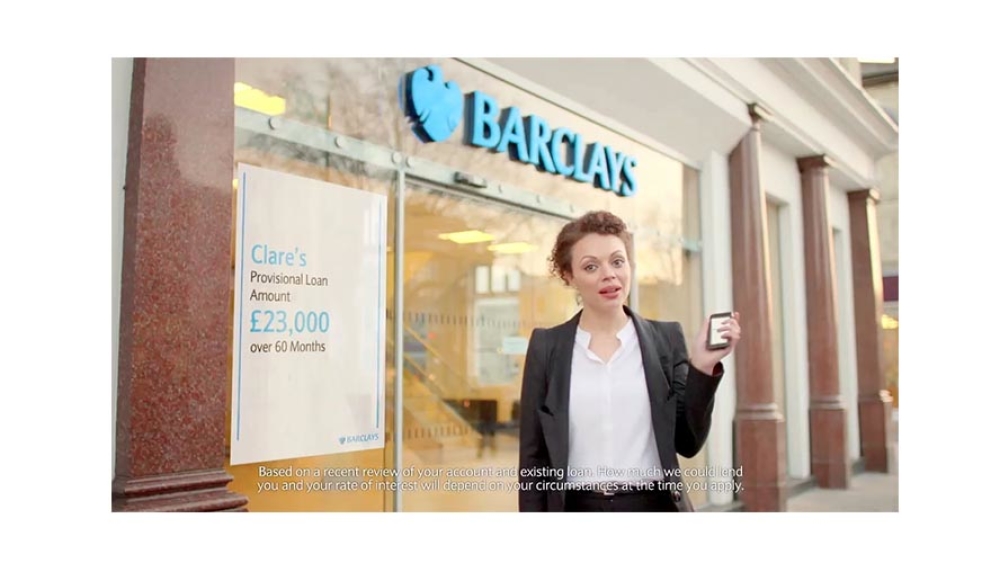

In a world of 'one size fits all' loan offers, Barclays offered customers an exact figure for how much they could borrow - before they applied.

14 May 2015

In a world of 'one size fits all' loan offers, Barclays offered customers an exact figure for how much they could borrow - before they applied.

Members enjoy unlimited access to the very best industry-leading insight, advice & inspirational content.

If your organisation is already a member of the DMA, please login or register to continue browsing.

If you are yet to join our community of over 27k+ marketers, just register your interest and one of the team will get in contact with you

If you are looking to download a report please request report here and select the report you’d like to access to get it straight to your inbox. If you can't see the report you'd like to access, contact: membership@dma.org.uk.

If are logged in and your organisation is already a member of the DMA, please contact your DMA Account Manager for further assistance.