Coronavirus: The Post-pandemic Consumer

22 Jul 2020

The pandemic we are living through will be remembered as a global tragedy that has affected all and taken too many lives. However, while people were finding new ways to cope they also discovered (or re-discovered) habits and passions that are turning into positive outcomes for individuals.

These two faces of the coronavirus pandemic show how complex and uneven this experience has been for all of us, something brands need to understand and consider when reimagining their relationship with their customers.

What are the new consumer behaviours, attitudes, expectations and worries that businesses must prepare to meet?

In the webinar series ’Re-Think, Re-Invent, Re-Engage’, Foresight Factory look at seven critical themes that uncover how consumers’ needs are changing, highlights scenarios brands need to plan for.

The pandemic impact on customers finances

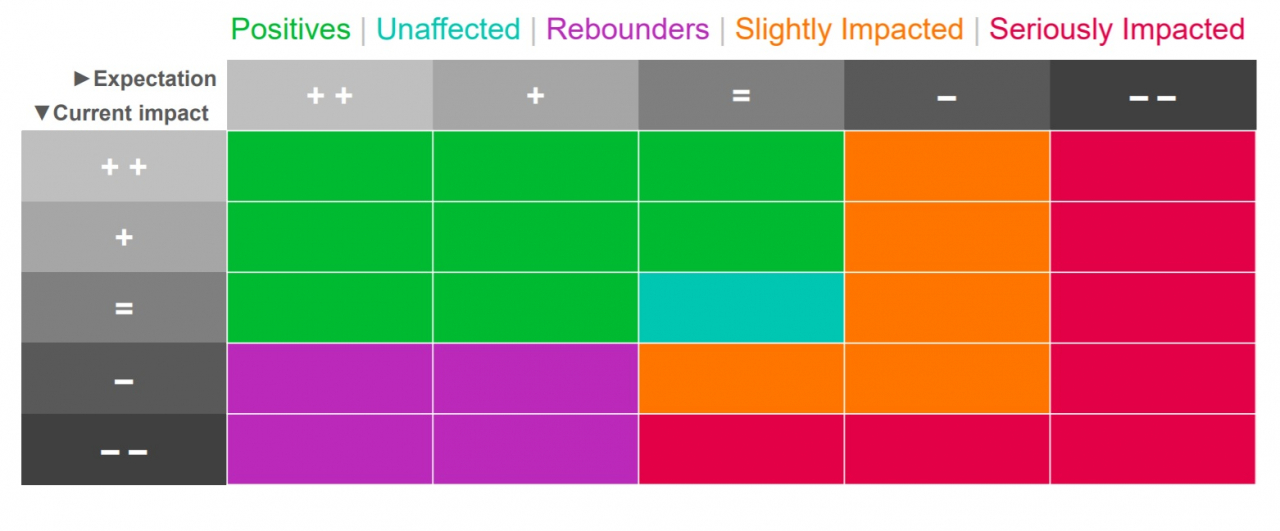

From the analysis of a fresh wave of global consumer research, Foresight Factory’s latest segmentation looks at how the pandemic has impacted British consumers’ finances (also comparing this to people in the USA).

By looking at the current and expected impact of coronavirus (over the next 12 months) on their personal finances, five groups were identified:

- The Positives – whose finances have improved during the pandemic and are expected to grow also in the future

- The Unaffected – whose finances have remained the same during these times and are expected to stay unvaried even in the future

- The Rebounders – whose finances have got worse due to coronavirus but are expected to improve in the next year

- The Slightly Impacted – whose finances have got a bit worse and are expected to go a bit worse in the future

- The Seriously Impacted – whose finances have been severely affected by the pandemic and are expected to go even worse next year

When comparing British consumers with their American counterparts, the latter group seems to be more positive about their financial situation and future.

When comparing British consumers with their American counterparts, the latter group seems to be more positive about their financial situation and future.

In the UK, 15% of consumers are positive and 35% say their finances have been unaltered compared to a quarter (25%) of positive Americans and 31% whose finances stayed the same during the pandemic. Similarly, the group of ‘The Rebounders’ is larger in the USA (12% vs 6% in the UK) meaning Americans feel more positive about the future.

Furthermore, in the UK, the groups of those whose finances have been slightly impacted (28%) or severely impacted (10%) are bigger than the same groups in America (respectively 18% and 7%).

Given that America has been slightly behind in the pandemic in terms of rate of infections, could potentially explain the consumers’ more positive attitude. Indeed, when looking at regional data, the North East US segmentation becomes more similar to the UK’s with a slight reduction for ‘The Positive’ group and an increase in numbers for slightly and seriously impacted consumers.

Who is in the five segments?

Following, the demographic characteristics Foresight Factory has found as the most representative for each group in the UK:

The Positives

Between 16 and 24 years old – Male – Self-employed – Parents of children under 18 years of age

The Unaffected

Over 65 years old – Female – Not self-employed – Less likely to ha and how are they ve children under 18 years of age

The Rebounders

Between 24 and 35 years old – More likely to have children under 18 years of age

The Slightly Impacted

No difference in age – Male – Not self-employed

The Seriously Impacted

Between 45 and 64 years old – Female – Self-employed

Consumers’ opinions on the future of the national economy, the risks they fear most and how they are planning to live through he near future have all been analysed for each segment. To find out more about those, tune into Foresight Factory’s webinar series.

You can also find out more about the latest views and challenges the data and marketing industry is coping with from the DMA’s own ‘Coronavirus: The Impacts on Business’ tracker research.

Please login to comment.

Comments