To compete, Vodafone must move in with its customers

17 Apr 2015

News struck last month that Vodafone UK's most senior marketer, Daryl Fielding, is set to leave the mobile operator after two years. Its CEO, Jeroen Hoencamp, was quick to acknowledge that Fielding has done a decent job. "In her two years with us, Daryl undertook a major strategic review and led the transformation of our brand marketing,”

“Her strategy and advertising campaigns have resonated with our people and consumers and have led to significantly increased brand measures in our marketplace”, he said on Tuesday. From a distance, you’d have to agree; there’s much to admire about the work she has overseen.

But, the landscape is changing in telcos. Fast. Consolidation is raging on and BT’s acquisition of EE presents a new threat to Fielding’s successor which hadn’t emerged under her charge.

It’s an uncertain time for Vodafone in the age of quad-play. If it is set to be involved in any kind of M&A activity or, as rumours indicate, further extend its proposition to compete; strong customer relationships are going to be a crucial asset. This could be to either increase its value to an acquirer, or to enable it to cross-sell effectively.

BT, by contrast, is well primed for this quad play era. For a start, it is an accomplished direct mail user. Our recent ethnography study shows that advertising mail, on average, stays there for 17 days1 and direct marketers will know it can be much longer. This in addition to its broadband and TV boxes gives it a strong representation in the home.

If Vodafone doesn’t defend itself, BT – along with Sky, Talk Talk and Virgin Media – could dominate share of voice in the critical place that I’d expect quad-play decisions to be made: in the home. Quad-play is necessarily a complex proposition for customers and the media choice the marketers make needs to reflect that.

As Suzi Williams, BT’s global brand and marketing director, herself says, “direct mail is a great way to explain things that can’t be explained in the TV format. It offers the ability to convey detail in a way that TV doesn’t.”

In short: BT is in the home and Vodafone needs to be in it too.

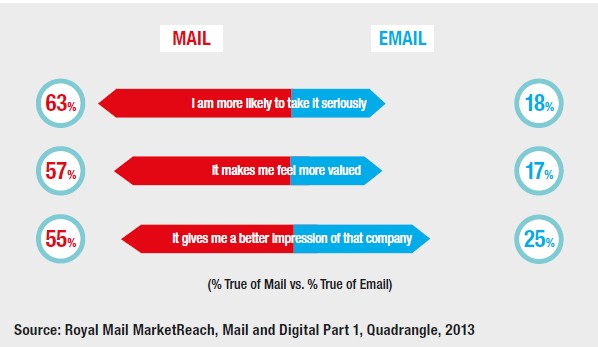

Whatever the future holds for the brand, Vodafone would be mad not to use mail to address this. As the whole industry turns away from acquisition and towards growing customer value – which you’d expect to see after consolidation on this scale – building a strong and lengthy emotional connection is paramount. Not only does our own research report 57 per cent of people saying that receiving mail makes them feel valued2, the latest IPA Touchpoints survey confirms that people read their mail on average for 22 minutes a day3; that’s more than magazines.

Telcos know this as well as anyone. According to Nielsen, the telco market sent a total of 183,867,672 mail pieces last year. Vodafone is the only mobile network not to spend anything on mail, despite its reported 23 per cent market share. So I’d argue that Vodafone must build a share of voice in the home which suitably represents its share of the market. Just as they might with other media.

Daryl Fielding’s successor can expect my call.

Sources

- Royal Mail MarketReach, Ethnographic Quant, Trinity McQueen, 2014

- Royal Mail MarketReach, Mail and Digital Part 1, Quadrangle, 2013

- IPA Touchpoints 5, 2014 (Data based upon Monday to Saturday reading)

Please login to comment.

Comments