JICMAIL Q3 2024 Results: Mail proves its sustainability credentials with +14% growth in recycle rates

05 Dec 2024

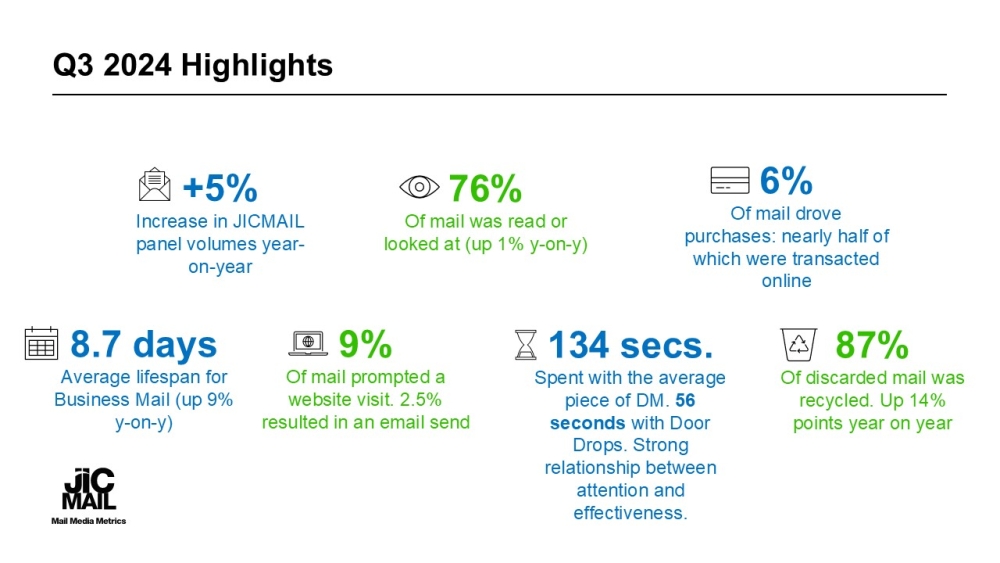

The latest quarterly results reveal that 87% of mail discarded within a 28 day period is recycled. Recycling rates have been growing steadily over the five quarters that they have been tracked by JICMAIL and are up 14 percentage points year on year compared to the 73% recorded in Q3 2023.

Q3 2024 results have revealed that volumes tracked on the JICMAIL panel of 1,100 UK households increased by 5% year on year in Q3 2024. With increased numbers of advertisers displaying confidence in Direct Mail and Door Drops, it is more important than ever to measure the environmental impact of the mail channel.

- While recycling represents only one element of a marketing channel’s sustainability credentials, it is timely to note that households and consumers have displayed more willingness than ever to recycle their discarded mail in Q3.

- Cross-sector growth was seen in Q3 2024 with Direct Mail volumes up year on year across the medical, travel, supermarket and retail sectors, and Door Drop volumes growing across all sectors apart from charities and automotive - contributing to a 20% growth in volumes overall.

- To date 7,137 advertisers have used Direct Mail or Door Drops between Q1 and Q3 2024 according to the latest circulation figures published by Nielsen Ad Intel.

- Frequency of interaction, item reach, mail lifespan and mail attention have all grown year on year for Direct Mail: these improved consumer engagement metrics providing a strong signal as to why advertisers are showing such confidence in the channel.

- Business Mail has displayed some of the largest improvements in engagement with lifespan growing 9.2% to 8.7 days on average, and frequency of interaction growing 3.1% to 9 overall.

- The strong linear relationship between mail attention and effectiveness, first explored in the 2023 JICMAIL study The Time We Spend With Mail, was reconfirmed in Q3 2024, with some of the highest attention mail sectors (supermarkets, government, medical, finance and utilities) also displaying some the highest rates of commercial effectiveness.

- 6% of mail prompted a purchase in Q3 2024, with nearly half of those purchases transacted online. 15% of mail prompted a discussion and 9% prompted a website visit, pointing towards the power of the mail channel in bolstering the efforts of owned and earned media.

- Noteworthy advertiser performances in Q3 2024 included Damart whose share of Direct Mail attention exceeded their share of volume, and Lloyds who did the same with their Business Mail.

- P&G Always proved to be the big attention winner in Q3, with its 6% share of volume out of the top ten Door Drop advertisers, generating 19% share of attention through their use of high impact voucher activity. P&G’s Q3 success provides a compelling case study as to the role the mail channel can play for big FMCG advertisers.

Read the full release here

Please login to comment.

Comments