JICMAIL NEWS: Q2 2021 results reveal the crucial role mail played in encouraging consumers back in store as lockdown restrictions eased

23 Aug 2021

Register for our next webinar: Q2 2021 Results: Introducing unrivalled competitor insights for mail

JICMAIL’s diary based data captured from a panel one thousand households every month reveals that in Q2 2021:

- Confidence in the mail ad market continued to rebound, with Direct Mail volumes on the JICMAIL panel increasing by +51% year on year, and Door Drops by +181%. Local elections played their part in driving political party DM and Door Drop volumes, as did continued covid related messaging from the NHS. The travel and mail order / online retail sectors also played a key role in market recovery.

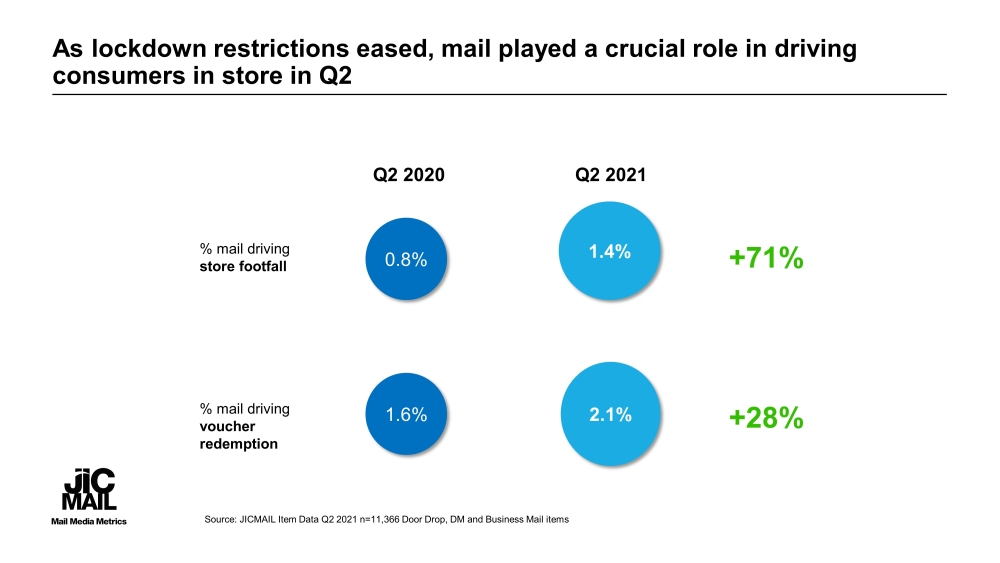

- Despite continued challenges on the high street, consumers returned to bricks-and-mortar retail stores in Q2 2021 as lockdown restrictions eased. Mail played a crucial role in driving consumers in to stores, with the 1.4% of all mail having a footfall effect representing a year on year growth in effectiveness of +71%. Vouchers played their part in prompting consumers to retail visit stores with 2.1% of all mail prompting a voucher redemption (+28% year on year).

- While mail played a significant role in driving physical store traffic, it also continued to establish its role in driving digital effects for advertisers. Mail’s effectiveness at driving consumer traffic to advertiser websites was sustained at a level nearly six times greater than its footfall effects, establishing a new normal in the role that mail plays in the digital customer journey.

- The average piece of DM was interacted with 4.4 times on average in Q2, and shared with 1.14 people per household – boosting mail campaign reach by 14% and generating ad impressions over four times greater than the mail volumes delivered. Door Drops recorded an average frequency of 2.99 and Item Reach of 1.06.

Key mail metrics for Q2 2021 can be summarised as follows:

|

Q2 2021 KEY MAIL METRICS |

|||

|

|

Frequency |

Item Reach |

Lifespan |

|

Direct Mail |

4.40 |

1.14 |

8.0 days |

|

Door Drops |

2.99 |

1.06 |

5.8 days |

|

Business Mail |

4.83 |

1.17 |

9.5 days |

|

|

Mail Driving Store Footfall |

Mail Driving Voucher Redemption |

|

Q2 2020 |

0.8% |

1.6% |

|

Q2 2021 |

1.4% |

2.1% |

|

YEAR ON YEAR % CHANGE |

+71% |

+28% |

Source: JICMAIL Item Data Q2 2021 n=11,366 Q4 2020 Direct Mail, Door Drop and Business Mail items

Mail interactions captured by JICMAIL panellists take many forms and range from opening and reading mail, to passing it on to someone else, putting it in the usual place, putting aside to look at later or taking it out of home (amongst a list of many other actions). In addition, JICMAIL captures the industry category and advertiser details of almost every mail item in its 190,000+ mail item database.

New competitive insights for mail:

- Analysis of key advertiser activity reveals that local election activity saw four of the top ten Drop Drop advertiser spots being occupied by the major UK political parties.

- The NHS continues to dominate the DM and Business Mail rankings with the continued roll-out of key Covid and vaccination communications.

- In addition, some of the nation’s top retailers - Tesco, Boden, Matalan, Boots and Specsavers - were all very active in the ad mail space in Q2, reflecting the increased effectiveness of mail in driving consumers in store.

With the mail market displaying an ever increasing demand for robust advertising insight, JICMAIL have today released a suite of new competitive insight tools to help advertisers measure their visibility on the door mat vs competitors; understand their mail performance vs other industry leaders; and draw out key insights into which consumer segments different brands are targeting with mail. If you are a JICMAIL accredited organisation login to JICMAIL Discovery today to learn more about these new competitor insight tools. To learn more about how to become a JCIMAIL accredited organisation click here.

Mark Cross, Engagement Director at JICMAIL added “The pronounced uplift in JICMAIL panel volumes is striking, with the multiple effects of mail continuing to impact both media and consumer behaviours over this period. The new normal of heightened digital effects from mail are evident again, and across this quarter, the effects of driving much needed store traffic and consumer value through vouchers a particular stand -out. The commercial activity generated by mail as captured by JICMAIL, demonstrates the channels clear relevance to the recovery effort in the economy.”

Please login to comment.

Comments