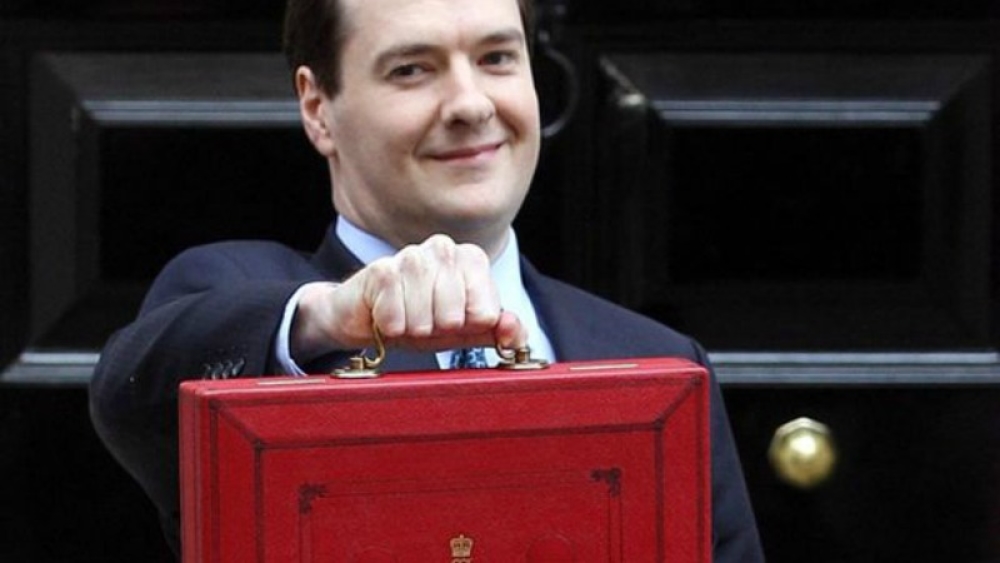

Budget 2015: George Osborne MP praises creative industries

18 Mar 2015

The chancellor was unlikely to announce anything as radical as last year’s pension reforms, considering there’s an election a few weeks down the line.

However, the independent body in charge of forecasting economic performance – the Office for Budget Responsibility – has revealed the chancellor will have £6 billion more to play with in the budget.

This is due to an economic boost from tax receipts that was better than expected and inflation reducing interest costs for the government.

George Osborne referred to the creative industries as one of the most vital sectors to the UK economy and praised their contribution.

Headline announcements:

Personal tax free allowance rise to £10,800 in 2016 and £11,000 in 2017

Leeds and other northern areas to be granted new powers in an attempt to invigorate growth in the north. This ‘Northern Powerhouse’ will attempt to emulate the success of London.

Investment in the internet of things

The government will provide a £3.5 million package to explore ways of protecting vulnerable people from nuisance calls

Expand support for video games industry

Changes to TV and film tax credits

A reduction in tax for alcoholic products

Employer’s national insurance contributions abolished for under-21s from April and for young apprentices from April 2016

Farmers will be able to average their income over 5 years for income tax purposes

Reducing lifetime allowances for pensions from £1.25 to £1 million

New bank levy of 0.21%, which is forecast to raise £900 million a year

The fuel duty increase scheduled for September 2015 has been cancelled

Backing home ownership with a first time buyer bonus

A new flexible ISA

A new personal tax free allowance of £1,000

Chris Combemale, executive director at the DMA, said on the lowering of the income tax threshold:

“Many who come into the marketing and advertising sector often do so through internships or low-paid placements. Anything that helps talented young people come into the sector is very much welcome.”

Please login to comment.

Comments