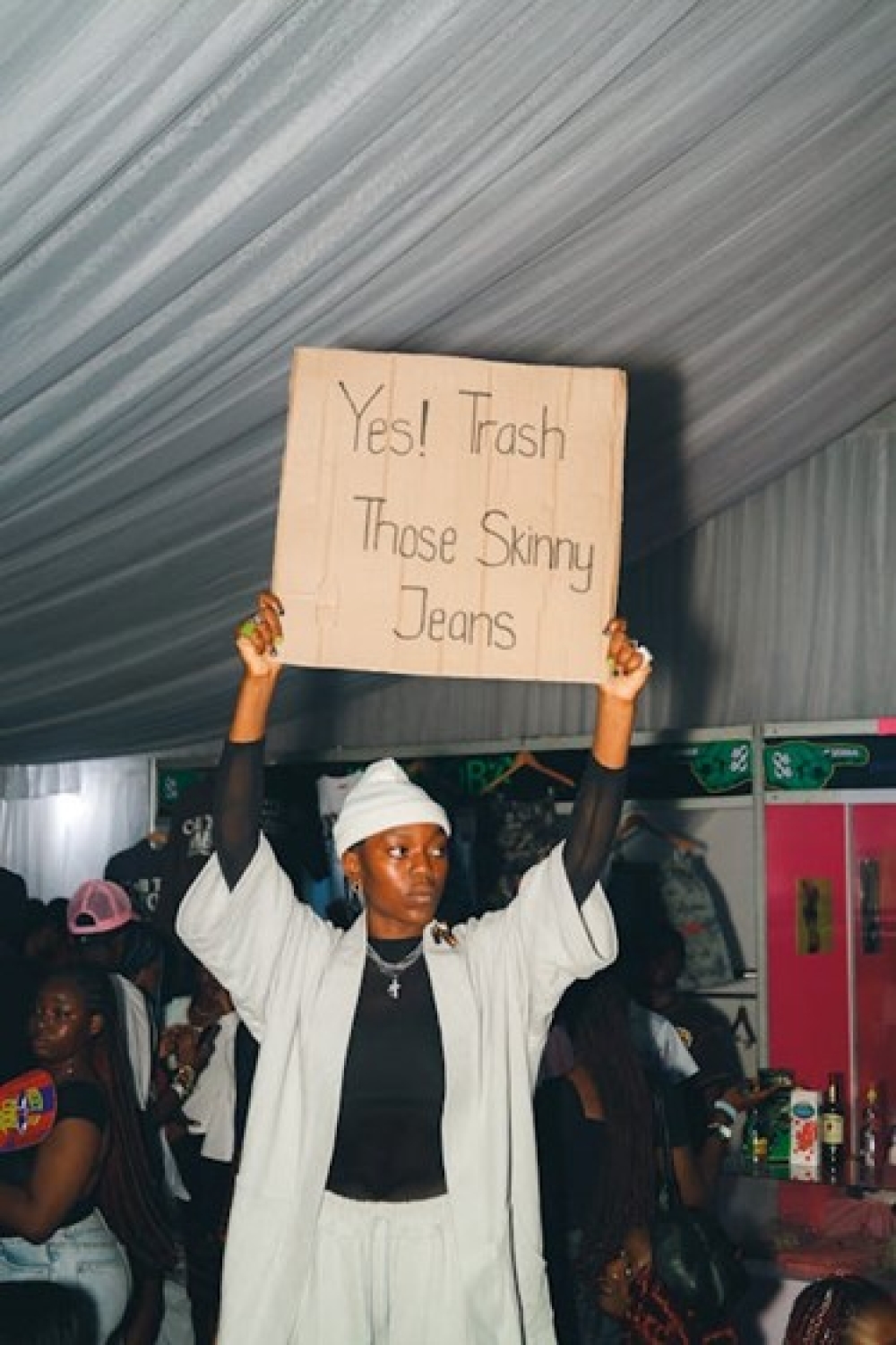

Are Earnouts Going the Way of Skinny Jeans?

25 Nov 2024

Earnouts, once the "skinny jeans" of M&A deals, are increasingly falling out of favour. For years, they were the perfect compromise: buyers could defer risk, and sellers had a clear incentive to deliver strong post-deal performance. But just like skinny jeans, their time in the spotlight seems to be fading—and for good reason.

At the heart of the issue is a tug-of-war over ownership and operational control. With an earnout in place, legal ownership doesn’t fully transfer until the final payment is made. For buyers, this is a logistical nightmare. They can’t fully integrate the acquired business, align cultures, or execute strategic changes without risking disputes. In fast-moving sectors like marketing communications, this delay can mean missed opportunities or, worse, a loss of competitive edge.

Sellers are also rethinking their stance on earnouts. These structures often breed conflict, as both sides struggle to agree on post-acquisition metrics like revenue, costs, and strategy. What starts as a collaborative partnership can quickly turn into a contentious negotiation, souring what was supposed to be a win-win deal.

What’s Taking Their Place?

Newer, more flexible deal structures are stepping into the spotlight. For example:

- Minority Retentions or Buyer Shares: Sellers keep a stake in their business or take equity in the buyer. This aligns interests on both sides while giving buyers the operational control they need. Sellers benefit from future growth potential and can exit later—often at a higher valuation.

- Deferred Payments and Price Adjustments: These alternatives tie payouts to pre-closing performance, sidestepping the common friction points of earnouts while still sharing risk.

These options offer a balance: buyers can integrate without delay, and sellers gain clarity and the chance for a second bite at the apple.

The Bottom Line

Earnouts still have their place, particularly in deals where future performance is unpredictable. But their rigidity doesn’t suit today’s demand for agility. Buyers want seamless integration; sellers want fairness and transparency. Neither side wants to be bogged down by the legal or emotional baggage of a complicated earnout structure.

So, are earnouts completely out of style? Not quite—but they’re no longer a default choice. Like skinny jeans, they’ll still work in the right situation, but only when the fit is just right.

Please login to comment.

Comments