Investigating Email: Getting Returns On Email

26 Oct 2020

As part of the ‘Marketer Email Tracker 2020’ report, sponsored by Pure360, we found that half of businesses (48%) are still using ‘Sales’ as the key metric to evaluate the effectiveness of their email marketing. We also saw the highest ever proportion of respondents (70%) say they’re confident their business can calculate the return on investment for their email marketing programmes.

Marketers’ ROI estimation remained strong in 2020 at £35.41 for every £1 spent, despite this being a decline compared to the dramatic increase seen last year, the long-term trend remains positive.

But what do successful programmes look like and the organisations that are running them? To find out, we returned to the data to dig deeper into what separates those with ‘High ROI’ from others. Read on to find more about how and which businesses are getting the best return on their emails.

High Return Organisations

To begin, let’s look at those organisations that tend to see a significantly higher return on their investment in email marketing. On a demographic level, while it’s unsurprising it is worth noting that these organisations are less likely to be a ‘Small/Micro’ business (companies with less than 50 employees).

So, what are the email practices and organisational qualities these organisations appear to have? Strategic support appears to be a significant factor. Indeed, ‘High ROI’ businesses, are significantly less likely to mention ‘Lack of Strategy’ as a significant challenge – 8% compared to 25% for other organisations – although this may also be a benefit of being resource-rich larger organisations too. Marketers reporting a higher return expect their email marketing budget to increase in the coming year (39% compared to 23% for other businesses).

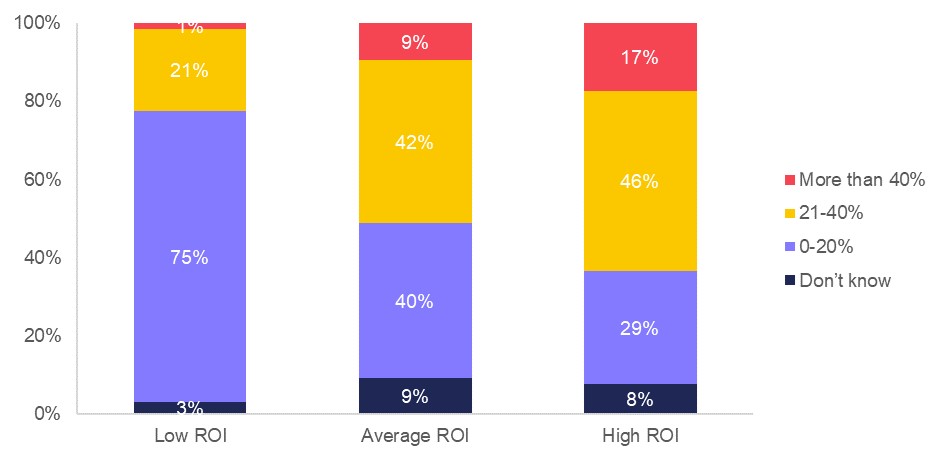

What percentage of your marketing budget is spent on email?

Moving on to the specific email marketing practices, ‘High ROI’ businesses are more likely to look beyond just email to offer ‘Advice, information or tutorials’ via ‘Post’ (21%) and ‘Messenger apps’ (25%) – in addition to ‘Email’ (54%), not instead of.

When asked about the types of email content that encourage consumers to sign-up to receive brands’ emails, these organisations are more likely to point to ‘Email receipts’ (33% compared to 14% for other organisations), ‘Trust the brand’ (39% compared to 23%) and ‘Advanced notice of new products/services & sales’ (39% compared to 25%).

These types of messages are repeated when asked about the emails that help achieve their campaign objectives too – ‘Email receipts’ at 46% (compared to 29%) and ‘Access to other brand benefits’ at 37% (compared to 17%). Highlighting the benefit of using email to engage existing customers and these generating interest, loyalty and repeat sales.

Low Return Organisations

Moving our focus to the other end of the spectrum, the only significant demographic difference is the business size as low return organisations are more likely to be ‘Small/Micro’ businesses – and less likely to be ‘Large’ businesses (with over 250 employees). These ‘Low ROI’ organisations don’t expect their email marketing budget to increase in the next 12 months (15% compared to 35%), but they do at least anticipate it staying the same rather than decreasing.

This feeling of support is also felt when it comes to developing and improving email skills, as these businesses are less likely to offer staff ongoing email-related training (63% compared to 82%). Going some way, potentially’ to explaining why ‘Low ROI’ businesses are less likely to report being ‘Advanced’ when it comes to the sophistication of their ‘Multi-channel integration’.

This is also seen in the channels, beyond email, that these organisations utilise to engage customers with different messages. They are less likely to offer ‘Order confirmations or delivery updates’ via Social media (12%), Messenger app (6%) or Phone (9%) compared to the other businesses we surveyed. They’re also less likely to offer ‘Advice, information or tutorials’ via ‘Text’ (3%), ‘Post’ (3%), ‘Messenger apps’ (7%) or ‘Phone’ (18%). As a result, they’re also more likely to rely on just ‘Email’ to send customers ‘Discounts, offers or sales’ – at 73% compared to 57% for other businesses.

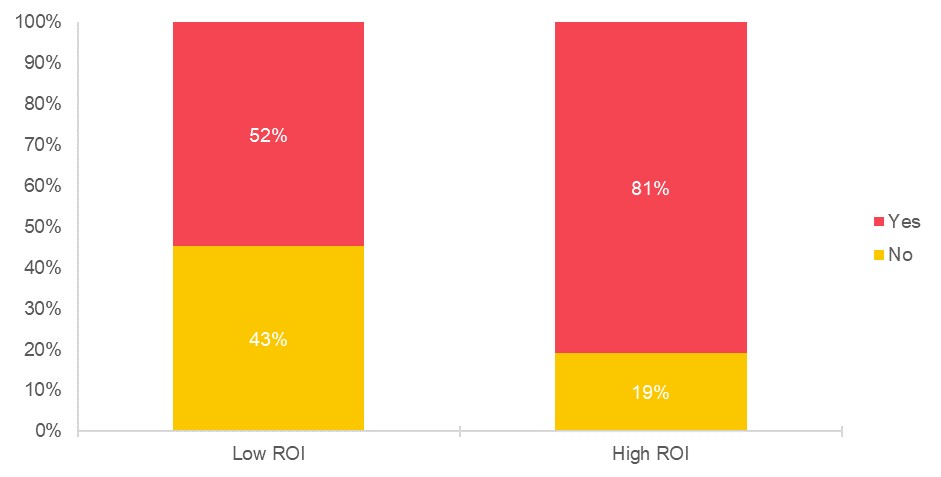

These organisations are less likely (52%) to have frequency of contact rules in place for email compared to 81% for other organisations. They are also more likely to say their opt-out rates have actually decreased over the last 12 months (50% compared to 30%). Possibly related to having these rules in place and concerns about the changes in legislation – not to mention the threat of enforcement.

Does your organisation currently have rules on how frequently you email an individual?

Looking at some of the specific content these organisations send, they are less likely to believe ‘Advanced notice of new products/services & sales’ (16% compared to 36%) and ‘Joining a loyalty programme or getting loyalty points’ (19% compared to 25%) encourage consumers to sign-up to their email programmes. They’re also less likely to say ‘Access to other brand benefits’ help to achieve their email programme’s objectives (9% compared to 31%).

Next Steps

So how do organisations turn things around? It may not be as simple as imitating those that are seeing high returns, as there are also some notable differences for those reporting an ROI closer to the average for 2020’s study.

For instance, ‘Average ROI’ businesses are more likely to offer ‘Order confirmations or delivery updates’ via ‘Messenger apps’ – at 28% compared to 9% for both ‘High ROI’ and ‘Low ROI’ businesses combined.

They’re also more likely to report ‘Competitions’ (40% compared to 21%), ‘Product reviews, user guides or other product/service-related information’ (40% compared to 23%) and ‘Advice, articles, information, tips or tutorials’ (37% compared to 20%) as the content that most encourages consumers to sign-up to a brand’s email.

So, there may be steppingstones on the path to the highest returns that are more attainable for those brands not seeing yet. It’s also interesting to note that it may not be about just sending more email too, as those organisations with a frequency of contact rule in place reported a higher ROI (£39.12 compared to £26.32).

The DMA’s Email Council also has some excellent advice and guidance for marketers, most recently with Guy Hanson’s article on the quick wins that might help those organisations not seeing the ROI they might expect: ‘Email ROI – Looking After the Little Guy!’

Ultimately, return on investment is a relatively short-term measure so it’s also encouraging to see that it correlates strongly with the estimate marketers made for the customer lifetime value. By putting customers first and engaging with them when and where they want, with the right processes in place and skillsets available, businesses can drive the value of their email programmes today and tomorrow.

To find out more about the findings from this year’s research, take a look through the Marketer Email Tracker 2020. Or for the consumer’s perspective on email, there’s also the Consumer Email Tracker 2020.

Ready to harness the power of email marketing? Check out our range of courses here.

Please login to comment.

Comments